Grow Your Business

Expand your financing knowledge with case studies provided by industry experts. Welcome to our library of free resources.

Vietnam Credit Crunch Raises Need for Financing

Vietnam’s tightening credit market has impacted SMEs and corporates from various industries. While the market has been experiencing a significant funding shortage, the government has been taking action to destress the economy and keep businesses moving.

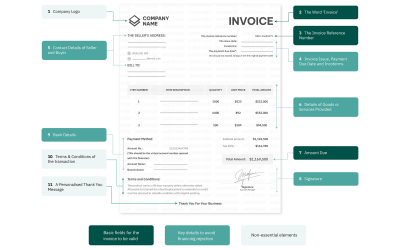

What is an Invoice?

While an invoice is a formal request for payment from the buyer to the seller, it is also a highly important document to attain financing. Unlock all you need to include in an invoice to access financing in this article.

Automation for Business Efficiency – Tools & Benefits

Businesses are moving towards AI-driven technologies to streamline operations. A combination of automation tools helps streamline operational workflows. Trade finance is embarking on a digital approach as well. Find out how in this article!

Velotrade is a Regulated SFC Licensed Trade Finance Platform

Velotrade was the first trade finance platform in Hong Kong to obtain the SFC license in November 2018. Why did Velotrade go to the considerable effort of obtaining this SFC license when the company commenced operations in 2017? Find out in this article!

Big Screen

Velotrade Secures Funding and Partnership with Vynn Capital

Velotrade Secures Funding and Partnership with Vynn CapitalWe are proud to announce our partnership with Vynn Capital; a...

Sunrate Partnership

Velotrade Collaborates with SUNRATE to Foster International Trade Velotrade is glad to announce its partnership with SUNRATE,...