Best Crypto Prop Firms in 2026: Ranked and Reviewed

Looking for the best crypto prop firm in 2026? We rank and review the top firms by payout track record, rules, profit splits, and platform quality.

You are viewing Velotrade in early access. The full platform is launching soon. Join the waitlist

From the founders of Velotrade (est. 2016), featured in

Prop trading allows traders to trade using firm capital after passing an evaluation. Traders follow predefined risk rules and receive a share of the profits, without risking personal funds.

Access a funded trading account once you pass the challenge.

You earn the majority of the profits you generate.

You never trade using your own funds.

Request payouts according to the rules, without lockups.

Step 1

Step 2

Hit the profit target while respecting daily and max drawdown limits.

Trade firm capital under the same rules with up to 90% profit share.

Request withdrawals under clear rules and get paid out on schedule.

Built by an established operating team. The same operational discipline and payout processes built over years now power our crypto prop trading model.

Original Velotrade team – over $2.5 billion actually processed and paid to clients worldwide since 2016.

Learn more about our historyWe never trade against you. Our institutional hedging turns your consistent profits into low-risk revenue for us. You focus on disciplined trading and drawdown control. We provide the capital, rock-solid platform and transparent rules. The better you perform, the more we both make.

Exclusively crypto. Higher leverage, simpler compliance, faster execution.

AI-driven hedging combined with institutional liquidity bridges live from launch. The same protection hedge funds and banks use.

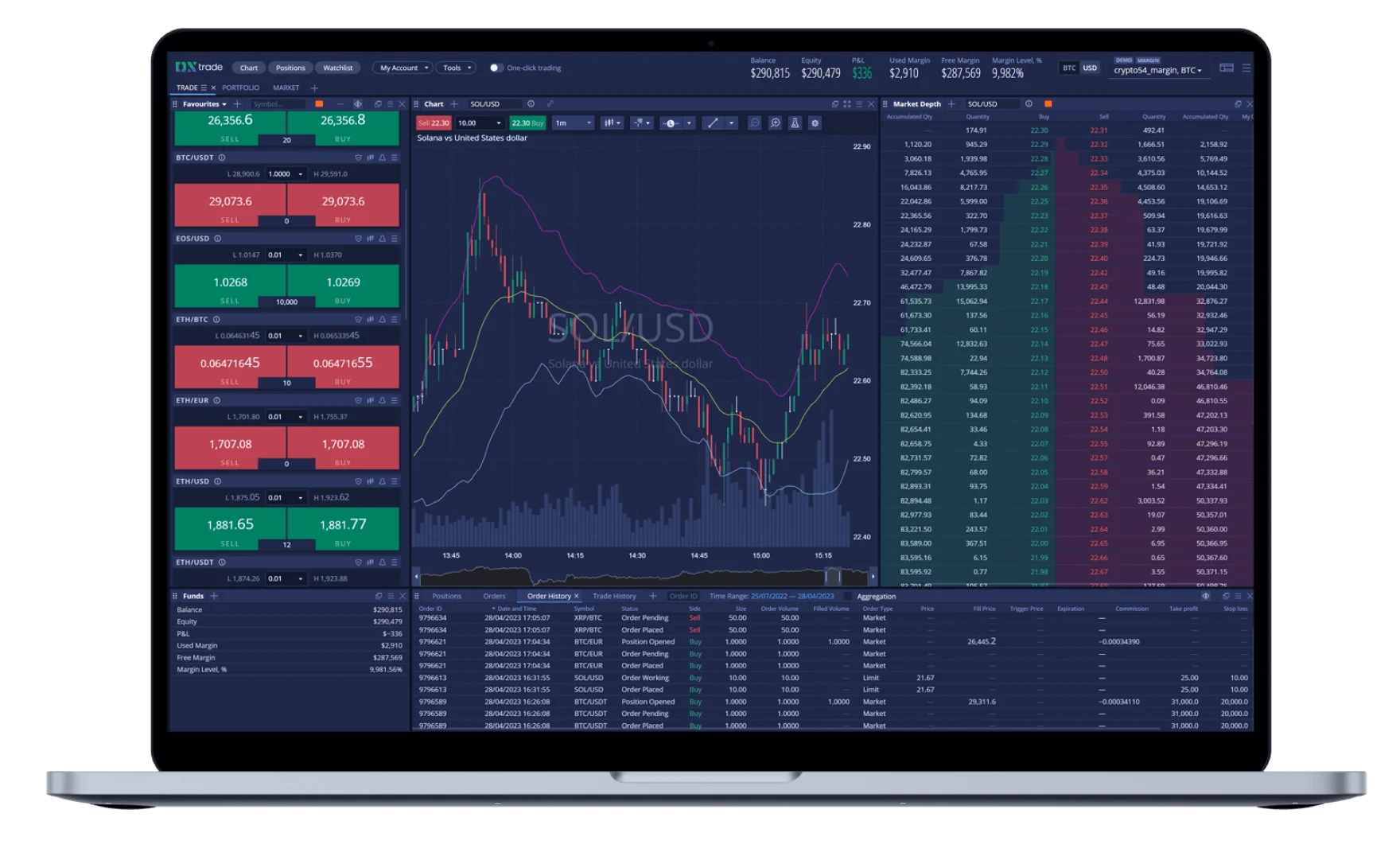

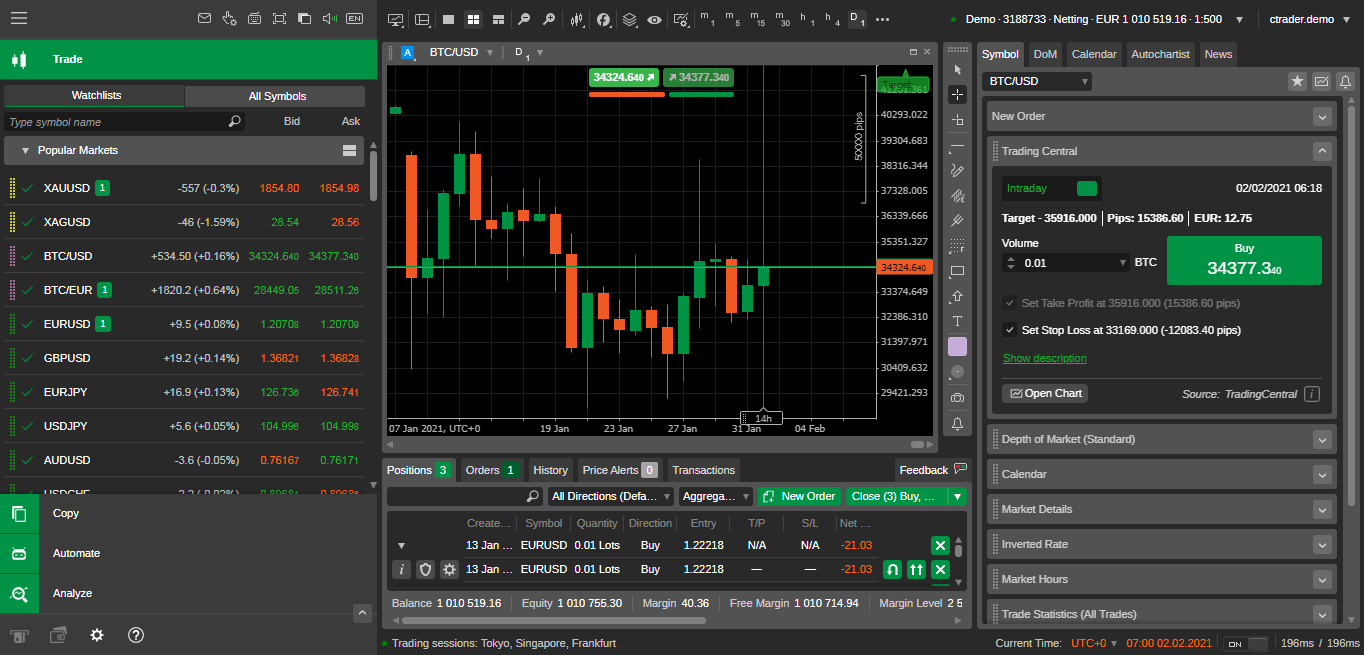

Professional trading conditions designed for serious traders:

Join a growing community of successful traders who are building their career with Velotrade.

"I've been funded with three other firms. Two of them hit me with hidden clauses at payout. Velotrade's rules are one page, no surprises. I know exactly what I'm working with before I buy. That's rare in this space."

"I've been trading perps on Bybit for two years, but always felt limited by my own capital. Velotrade lets me trade the same markets, same style, just without worrying about blowing up my savings. It's the missing piece."

"I watched prop trading videos for months before I actually signed up. The evaluation was tough but fair. No trick rules, no gotchas. Passing Phase 2 felt like proof that I'm not just dreaming. Now I'm funded and learning every day."

The original Velotrade legacy business paid out over $2.5 billion to clients worldwide since 2016.

Choose the account plan that best fits your trading goals.

Trading period

Min. trading days

Max daily loss

Max overall loss

Profit target

Profit split

Selected challenge

One-time fee

$540

Since 2016, Velotrade has meant trust: pioneering online invoice finance in Asia with institutional-grade risk management. The same founding team, built by traders, for traders, now delivers that reliability to crypto prop trading with transparent rules and payouts you can count on.

Year founded in Hong Kong

Paid to clients worldwide

Chief Executive Officer

Formerly in the derivatives trading desk at Dresdner Kleinwort in London. Subsequently founded and ran a proprietary HFT firm in FX and Equity Indices out of Singapore.

Executive Chairman

Former equity-derivatives trader at JP Morgan, Dresdner Kleinwort and Bank of America in London. Later Head of Brokerage at a global broker in Hong Kong.

Expert analysis, trading strategies, and industry insights from the Velotrade team

Looking for the best crypto prop firm in 2026? We rank and review the top firms by payout track record, rules, profit splits, and platform quality.

Compare funded trading and leverage trading. Learn how risk, autonomy, profit sharing, and rule enforcement differ between the two models.

Understand daily loss limits, drawdowns, trailing drawdown mechanics, and why most prop trading accounts fail due to rule breaches rather than strategy.

Clear answers on evaluations, payouts, and rules. For everything else, visit the full FAQ page.

Visit the FAQ pageKeep most of what you earn

Trade with our capital

Withdraw anytime