Whether you are an established eCommerce business manager or a newbie, this article will shed light on eCommerce insights and statistics that can help your business grow to new heights:

![]() Highlights of this article:

Highlights of this article:

- What is Driving eCommerce Growth?

3 reasons why eCommerce is booming: Immersive Tech, Personalisation and Data - Lucrative Markets Businesses Should Tap Into

Developing and BRIC countries establish their digital footprints - Sectors That Perform Better Online

The rise of Consumables and Apparels outside the West, and the trending second-hand market - Profitable eCommerce Platforms

Amazon does not top the list - Future of The eCommerce Market

eCommerce financing further expands online business growth

Content

Given the lower barriers to entry, competition in the online world is fierce. Targeting the right market with the right product through the right platform is essential.

Why is eCommerce Growing Quickly?

The enhanced user experience of online shopping is why eCommerce follows an upward trend. The pandemic forced consumers to become more digital, nourishing the natural evolution of shopping.

Nearly everything is now accessed digitally.

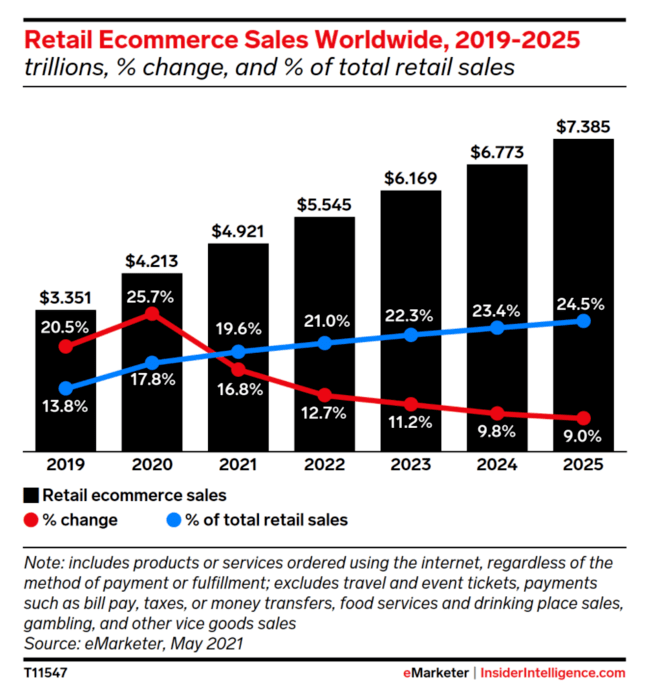

While other industries may have faltered during Covid-19, retail eCommerce sales worldwide surpassed USD 4.2 Trillion in 2020 with a 25.7% surge.

Retail eCommerce sales worldwide from 2019 to 2025 (in billion USD).

Besides wider choices and accessibility, technological advancements make eCommerce a more personalised shopping experience.

Immersive Technologies in eCommerce

Immersive technologies, including augmented reality, 360° views, interactive VR videos, are transforming the eCommerce industry.

The gap between online and offline shopping experience is bridged – Users can now interact with products digitally. Also, the emergence of the Metaverse is reducing the gap even further.

The convergence of eCommerce and the Metaverse will create a seamless, innovative, and personalised experience for online shoppers.

The eCommerce giant Amazon has already incorporated new tech into its marketplace.

Amazon’s AR shopping experience with Room Decorator.

With Amazon’s newest AR shopping tool, Room Decorator, users can see how furniture and other home décor items look in their space. Users can see multiple products together and save snapshots to review and decide later.

The vast amount of data offered by these technologies let eCommerce platforms automate product suggestions, cross-sell, and retarget consumers.

The Importance of Personalisation

Shoppers have selective attention – they tend to focus on desired sections and ignore the rest.

Personalisation in eCommerce solves this problem: items related to specific users automatically populate next to each other on the interface.

With Amazon’s newest AR shopping tool: Room Decorator, users can see how furniture and other home décor items look in their space. They can see multiple products together and save snapshots to review and decide later.

The vast amount of data offered by these technologies let eCommerce platforms automate product suggestions, cross-sell, and retarget consumers.

eCommerce sites can dynamically personalise product offerings based on users’ past shopping behaviour, demographics, location, and other browsing details.

Data-driven Omnichannel Journey

Personalisation not only benefits users but suppliers as well.

Retailers can perform better data-driven segmentation with granular customer profile details; targeted marketing is more precise but becoming more intrusive.

This segmentation of shoppers enables an omnichannel retail strategy to connect all online and offline touchpoints. Targeted ads can address users’ requirements more accurately.

Although operating an online business may appear cheaper than owning a physical store, substantial ad costs are involved. Online ad expenditures can often exceed the amount spent on capital, inventory stocking, staff, or other resources.

Moreover, deploying these advanced technologies can be even more costly. However, the climb in global ad spending is positively related to eCommerce growth.

New technologies are still emerging, but their integration has changed the eCommerce landscape.

Users demand immersive experiences that emphasise engagement and customise journeys based on their own needs.

This marriage of convenience between supply and demand creates a situation where both retailers and consumers are heavily incentivised to migrate online.

eCommerce Growth by Region

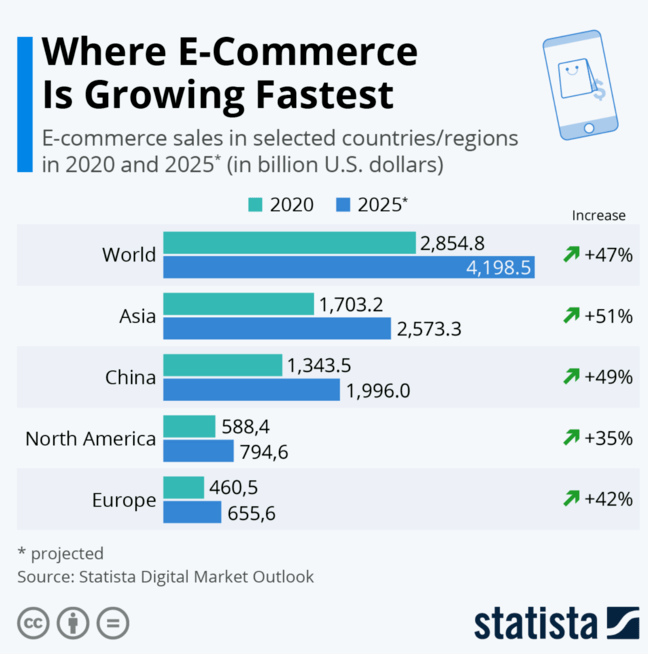

Bloomberg predicts that the global eCommerce market could be worth USD 16 trillion by 2027.

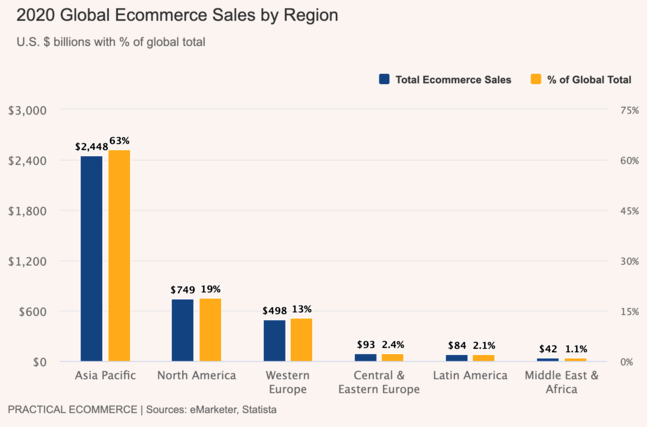

Much of the eCommerce industry will be driven by the Asia Pacific region, with China leading the parade.

Developing Countries Take Pace

Although many Asian countries are still developing, they will be highly competitive with enhanced infrastructure and technology.

Global eCommerce Sales by Region, 2020

At present, APAC leads eCommerce globally, and there is still room for massive growth in this region because:

- Nearly 60% of the world’s population comes from Asia.

- The average eCommerce sales per capita are still lower than in North America.

In the short term, we can attribute this statistic to the fact that Americans typically have more disposable income than their Asian counterparts.

However, Asia can experience exponential growth than more developed regions due to its population size in the long run.

eCommerce: China vs the US

As one of the biggest eCommerce markets, China accounts for a significant percentage of APAC growth. eCommerce sales from China were projected to be over three times more than in the US last year.

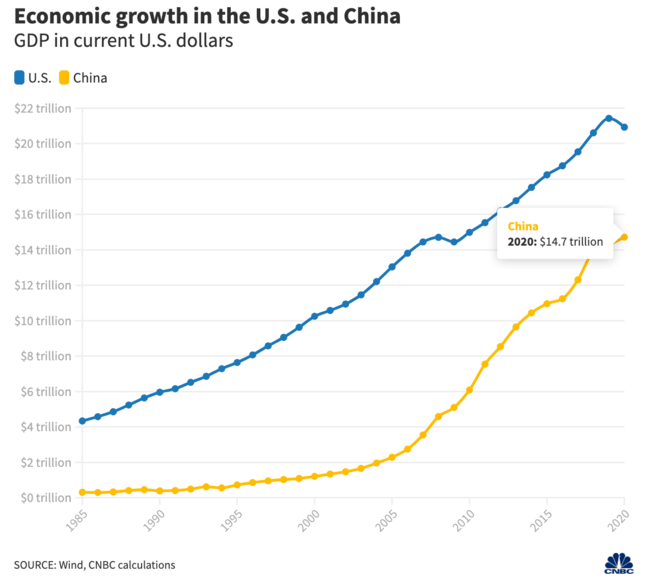

True that China still has a considerably smaller GDP than the US.

However, with current growth projections, China could overtake the United States as the dominant global economic force by 2028.

Economic Growth in the U.S. and China (GDP in USD).

China has already overtaken the USA in the eCommerce space due to its higher online retail sales. About 97% of Chinese consumers buy through local eCommerce platforms.

China’s growing buying power and digital payment systems contribute to its eCommerce growth.

In China, eCommerce makes up nearly 16% of total retail sales compared to 7.5% in the US.

Undoubtedly, China’s rapidly growing online consumer base makes it a competitive yet lucrative target market for eCommerce businesses.

eCommerce Suppliers in BRIC Countries

While China can hardly be called an emerging economy, the other three BRIC countries: Brazil, Russia, and India, are establishing their footprints in digital commerce.

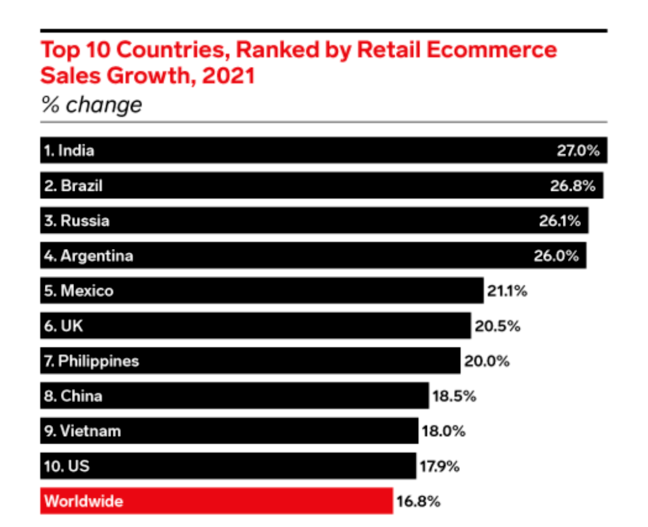

Top 10 countries ranked by Retail eCommerce Sales Growth, 2021

Low labour costs are key factors contributing to the substantial growth in these economies. Lower production costs are like a magnet for eCommerce sellers seeking to outsource and import goods.

BRIC countries are expected to be the dominant suppliers of manufactured goods and raw materials in the future.

eCommerce businesses should capitalise on such opportunities.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

How can you capitalise on these market opportunities? Unravel the definition of eCommerce financing and grow your business with extra working capital.

Industries to Target

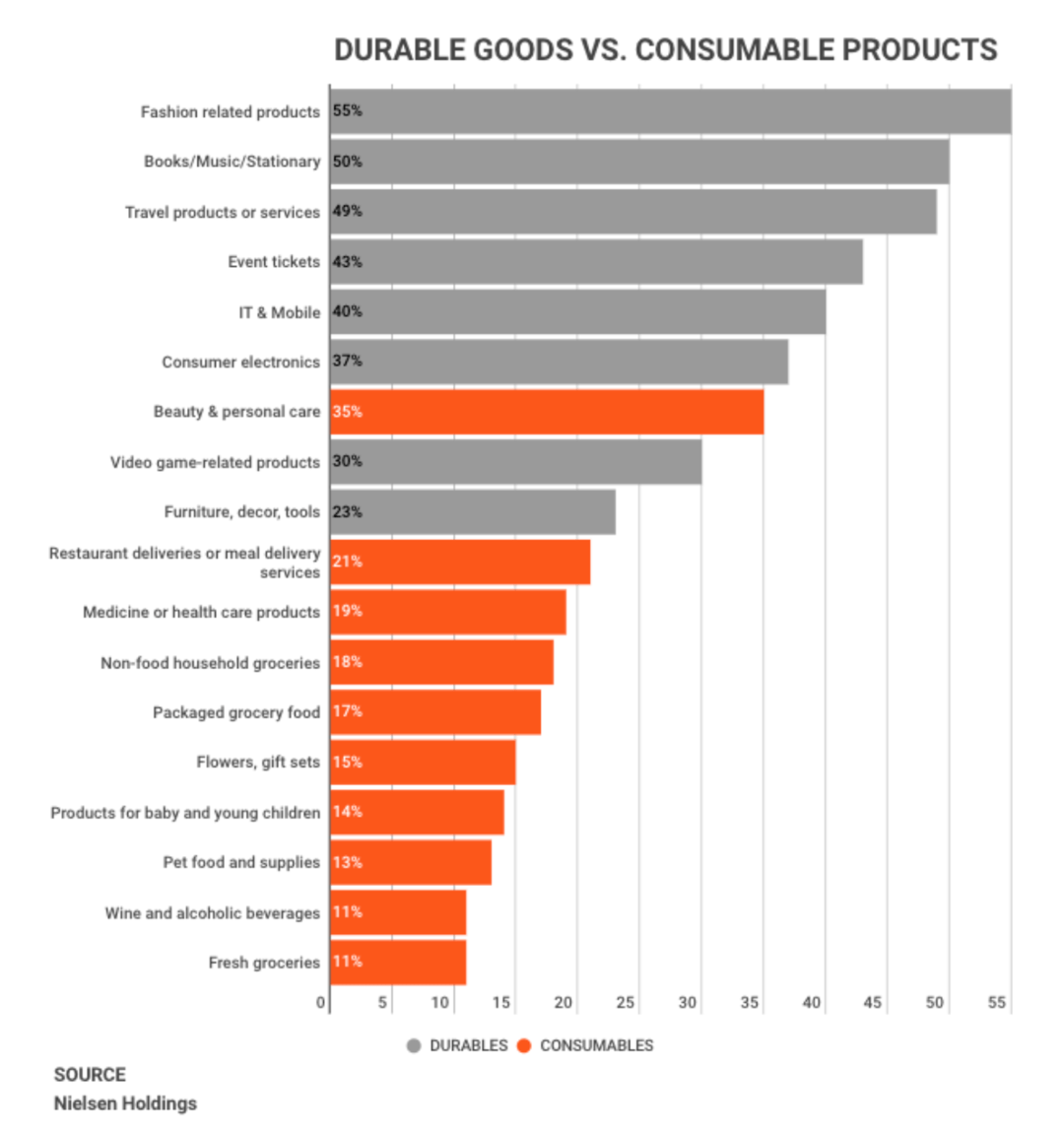

Market research suggests durables are better sold online. Durable items are used multiple times without depleting, while consumables include perishable items with a shorter lifespan.

But, what do online shoppers seek?

Let’s have a look.

Durables & Consumables Online

Consumer interest in consumables online can be affected by the following factors:

Logistic pain points:

- The unguaranteed freshness of items like fresh fruits and vegetables

- Faster delivery is required for consumables purchased with more urgency and less forethought

- Unfavourable return policies for consumables

- Lower consumer trust in online products for personal consumption

The table below shows the gap between the eCommerce sales of durables and consumables back in 2018:

Percentage of category items bought online by Nielsen Holdings in 2018

Fast forward to 2021

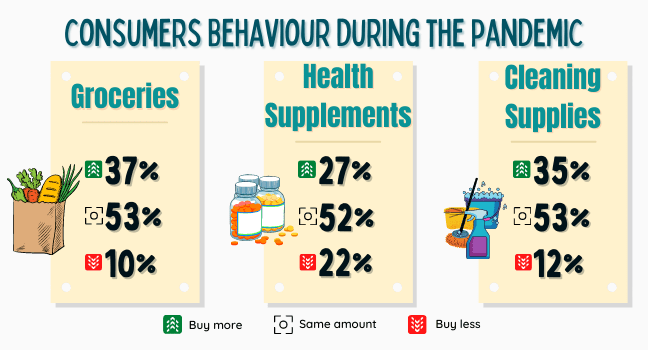

Lockdowns during COVID have forced changes in consumers’ shopping behaviour and suppliers’ business models.

Such changes can be easily observed in the US.

According to the report of Fastest Growing eCommerce Categories in 2021, a significant number of users accepted buying consumables online.

The most progressed categories in the US were groceries, cleaning supplies, and supplements.

Convenience and assortment of products are key drivers behind this shift, also propelled by the demand for online grocery shopping during the pandemic.

As omnichannel strategy becomes pivotal for businesses to succeed, the FMCG online market will outpace offline growth. eCommerce is now a central part of the growth strategy for most big FMCG players.

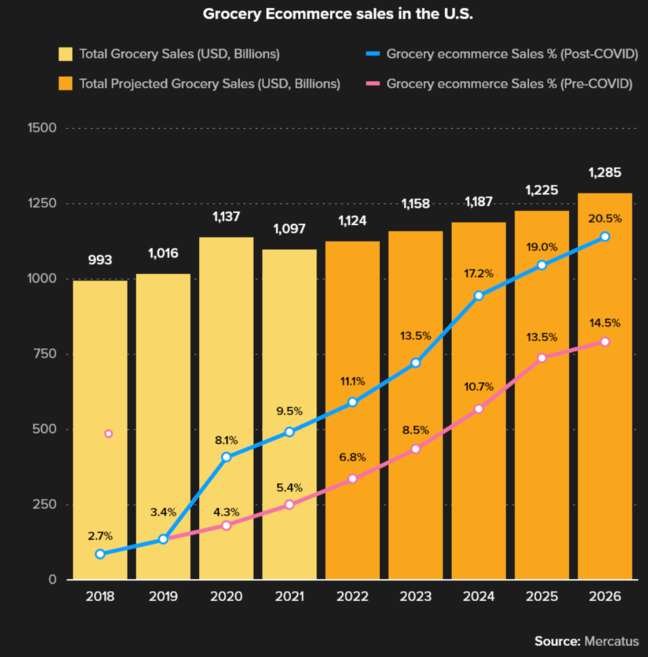

The US market alone is forecasted to witness a 20.5% rise in online grocery sales, despite its relatively lenient covid restrictions.

Grocery eCommerce Sales in the USA

Suppose more medium buyers turn into heavy buyers. In that case, the consumables market will be highly profitable for online merchants due to the high purchase frequency.

The consumables online market is still growing, and it is time to tap into this sector.

It’s another successful marriage of demand and supply: previously unmet consumer needs are matched by businesses ready to adapt responsively.

Online Fashion: $713B Global Industry

Shopify’s forecast says online fashion will be a USD 713 billion global industry soon, continuing to account for a considerable percentage of eCommerce sales.

The apparel eCommerce market is expanding and growing outside the western hemisphere.

Millennials and high-income earners are leading online shoppers. APAC houses a significant proportion of these millennials, including a few of the most populated countries like India and China.

These countries are also one of the fastest-growing eCommerce markets for this reason. The most downloaded shopping app in 2021: #2 SHEIN is a China-based leader in fast fashion. #3 Meesho is an India-based social eCommerce platform focused on fashion and home.

Fashion is a highly fragmented market comprising numerous product types, offering substantial market opportunities.

The athleisure sector is a branch of fashion that has propelled this market’s growth. Previously valued at USD 155.2 billion in 2018, it will reach USD 257.1 billion by 2026.

Moreover, the athleisure sector has low digital barriers to entry and emerging economies like India offer cheap production costs for suppliers.

As consumers become more health-conscious and eco-friendly, the demand for sustainable fashion is expected to surge.

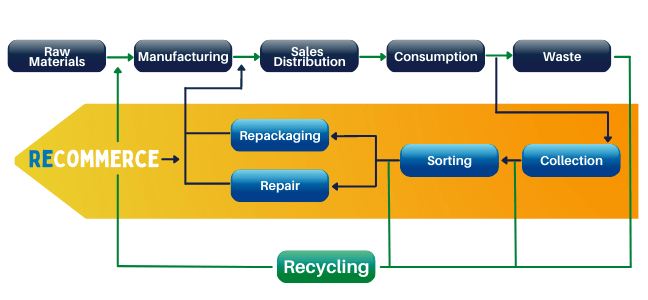

ReCommerce: a Market for Pre-owned Items

Consumers are now highly attracted to what is known as ReCommerce, where they buy or rent products (e.g. apparel), then resell after consumption.

This model is much more economical for both buyers and suppliers.

44% of surveyed Americans have bought or sold a previously owned item online over the last year.

With higher environmental awareness, more shoppers have started using some resale marketplaces. The most popular product types in the Recommerce market are clothing, books, and electronics.

The second hand market is expected to double from 2021 to 2025, reaching billion, 11x faster than the broader retail clothing sector.

Such an opportunistic market not to be missed!

Again, the user experience of a platform is vital – whether you are creating your own or leveraging the existing ones.

![]() Key Takeaways

Key Takeaways

- Greater Interactivity and Personalisation are Accelerating Ecommerce Growth

Technologies like AR and VR are enabling online firms to engage, retarget, cross-sell, and customise based on past user behaviours. - China and BRIC Countries are Taking Pace

China’s growing buying power and low labour costs in developing countries are attracting eCommerce growth. - Consumables, Fashion, and ReCommerce are the Most Attractive Markets

Rental of goods is more economical for both buyers and suppliers, reducing waste while increasing eCommerce growth rapidly.

eCommerce Platforms for Growth

By now, you know what to sell and whom to sell online, but through what eCommerce channels?

The two most common ways are:

- build your own eCommerce sites with some eCommerce service providers;

- choose an eCommerce marketplace.

What’s the best part?

These channels are not always mutually exclusive. Surely one can sell on multiple platforms – below are the statistics of the top ones for your reference.

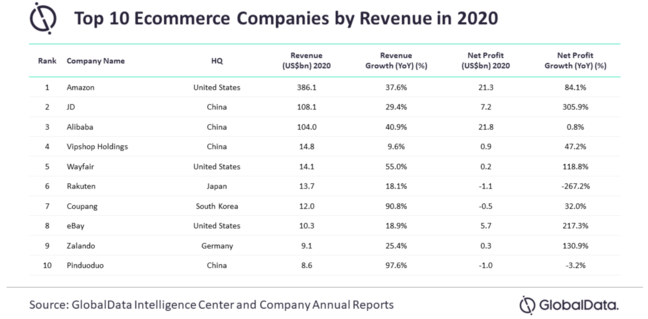

Most of the top eCommerce companies grew by double digits in 2020 despite the economic pressures of COVID-19.

Amazon has a staggering monopoly in western markets. Although it saw the most significant revenue growth, it is not the leading player in terms of profit.

Chinese platform JD attained an astonishing 306% YOY growth in net profit driven by a radical increase in active customers during the outbreak. It makes China a holder of the world’s second-largest eCommerce platform.

Meanwhile, as eBay’s agreement with PayPal expired, it attained the freedom to control and manage its payments globally.

The eBay experience is now more seamless for users and sellers alike, leading to a migration of 13 million sellers to the platform by the end of Q2 2021.

The growth is hence reflected in its astounding net profit.

Another US platform Wayfair reported high net profit growth for the first time in five years. The site experienced an increase in active customers and order frequency that enabled it to pay its dividends and operating expenses.

Top eCommerce Companies by Revenue, 2020

On the contrary, Japanese platform Rakuten saw a massive plunge in net profit with a decline of 267%. The company experienced a net loss in 2020 due to increased operating expenses.

While Amazon is still a leading player in the market, businesses should not underestimate the potential of other platforms.

Learn the benefits of eCommerce financing and accelerate your business growth by targeting opportunistic markets like China.

The Future is eCommerce

While developed countries with high consumption levels are already seeing a massive increase in eCommerce, developing countries are also catching pace.

Fastest eCommerce Growing Countries vs Worldwide Projection

Technological advancements have made the market more attractive.

Continuous innovation is essential for sustainable business growth in the eCommerce industry.

The market produces immense value for both consumers and producers. We are only seeing the beginning of an economic movement that will change the way we shop as a society forever.

Therefore, firms need to leverage emerging technologies, countries, and products to grow or establish their eCommerce business if they want to stay ahead in the game.

Learn how an eCommerce financing solution can help your online business grow.

Act now or fall behind!