An invoice is a time-sensitive document issued by the seller to the buyer as a formal request for payment.

As buyers and sellers often agree to trade on credit, an invoice usually specifies the credit terms of the deal. It is a highly important document to attain financing wherein an invoice is used as security to access a percentage of the amount due through a lender.

Unlock all you need to include in an invoice to access financing in this article:

![]() Highlights of this article:

Highlights of this article:

- What Does an Invoice Need to Access Financing?

Important details that are a must have - The Different Functions of an Invoice

How it helps in making accurate projections while simplifying admin processes - Digital Invoices are Ideal for Your Business Financing

Learn the benefits and partner with a FinTech

Content

What to Include in an Invoice for Financing?

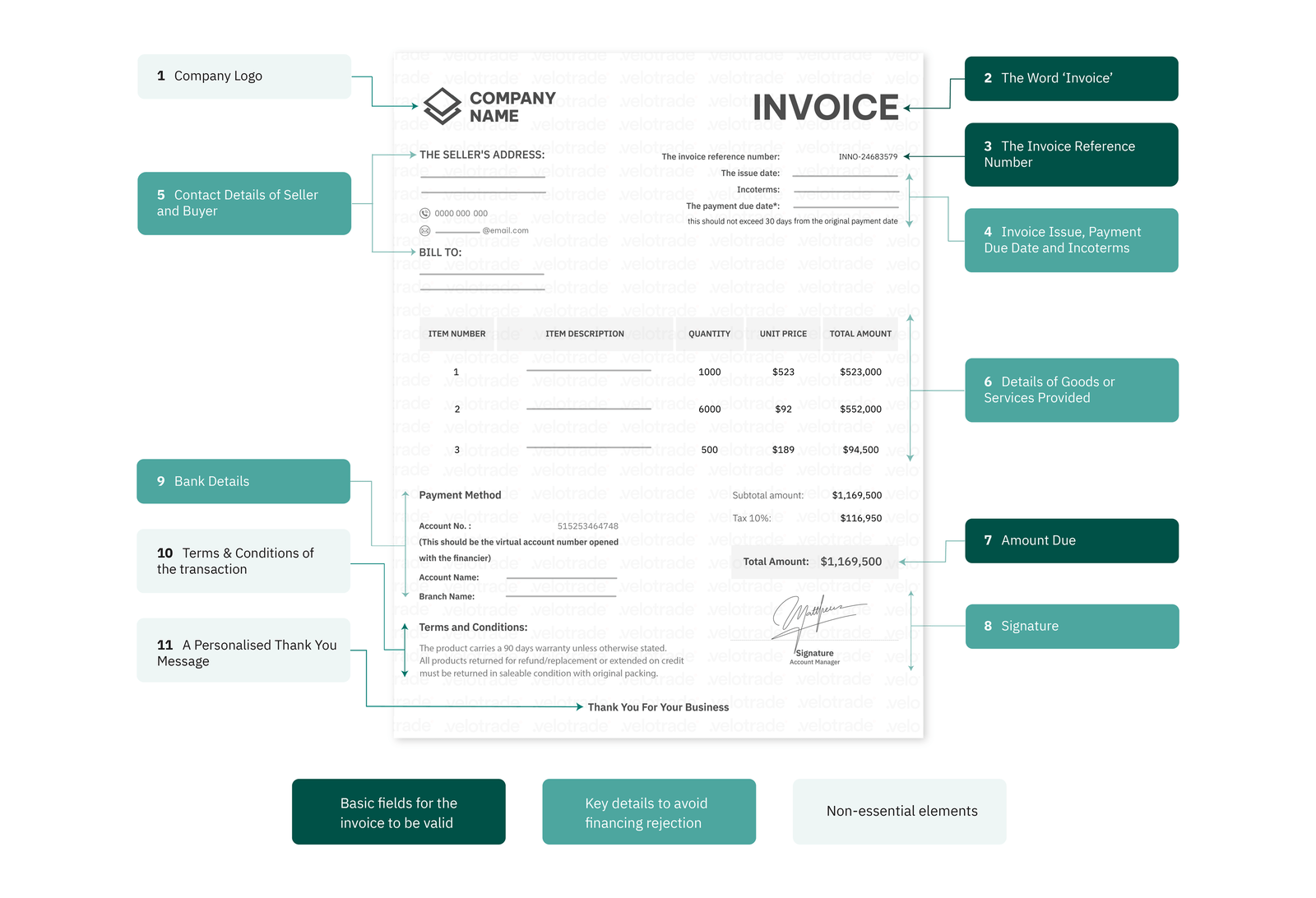

An invoice of any kind will need certain basic fields to be considered valid. This includes elements like:

- The word ‘INVOICE’

- A unique identification number

- Amount due

Additionally, a securitized invoice must be more scrupulous and requires further details.

To avoid financing request rejection, your invoice should include:

Contact Details of Both Parties

This includes the full address of both the buyer and seller and allows the lender to easily verify the transaction.

Invoice Issue and Payment Due Date

Clear payment terms allow the vendor to assess the risk associated with the maturity period of the asset.

Incoterms

These are a set of 11 individual delivery terms that define who bears the:

- transport costs

- insurance

- taxes

- point of risk transfer

This shows the responsibilities of buyers and sellers for the goods in trade.

By including these terms, you show a lender that you are aware of the rights and responsibilities you have as a seller.

Itemized Details of Goods or Services Provided

Clarity in the details of goods or services provided is important to prevent disputes.

From a lender’s perspective, this reduces the likelihood of defaults due to customer dissatisfaction.

Bank Details

Even if an invoice is not paid into a bank account (i.e. paid in cash) a lender will almost always need bank details to offer an advance on payment.

For a successful transfer of funds through financing, the bank account number of the account opened with the financier must be provided.

Signature

A signature, be it digital or physical, represents an extra layer of verification and security for all parties involved.

For the lender, it reduces the default risk as it shows an agreement of all involved parties to the terms set out in the invoice.

Have a look at the sample below!

Additionally, some other non-essential elements would be:

Company Logo

This can help build brand equity with buyers. It showcases a business’s professionalism.

A Standard Format

This varies from company to company, but a standard format makes admin easier.

A general practice is to place:

- On the Right : invoice number, amount due, issue and payment due date, and signature

- On the Left: Seller and buyer’s contact details, itemised details of goods or services provided

- On Either Side: seller’s logo and customised thank you message

Specific shipment details like incoterms are usually placed before after the item descriptions.

A Personalized Thank You Message

This further helps build brand equity and loyalty. Adding a personal touch helps establish strong customer relationships.

Terms & Conditions of the Transaction

While not compulsory, this can be a useful legal tool in the event of a dispute.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

Want to learn what document is sent from the buyer to the seller? Read more about Purchase Order!

What is an Invoice Used for?

The primary function of an invoice is to request timely payment from clients.

However, the document offers several other functions and benefits for businesses:

Legal Protection

An invoice stipulates a record of agreed upon terms and purchase details. Thus, it serves as legal proof of payment in the event of a dispute.

It can be a valuable document to protect the business against any legal action.

Marketing and Accurate Forecasting

Invoicing is often the first port of call when it comes to documenting the financial inflows of the company.

Data from invoices can help identify customer purchase patterns and inventory fluctuations. This provides invaluable insights for future strategic decisions.

Aids Tax Filing, Bookkeeping and General Admin

Tracking invoices makes otherwise tedious activities within a business simple and intuitive. These records simplify admin tasks and make them less prone to human error.

These invoice records also help in bookkeeping for accounting purposes. This not only helps them assess your financial performance but also helps you monitor your profit and cash flow.

As a result, the investor reporting and tax filing process are also eased.

Digital invoices or records further make the data collection and analysis process more efficient.

Financing with Digital Invoices

One of the key driving forces behind the benefits listed above is the increased integration of technology in the invoicing process.

E-invoicing is estimated to reach a value of nearly 30 billion USD by 2027.

More than an emerging trend, it is becoming a standard industry practice.

With the global e-invoicing market expected to project a CAGR of 17.40% in 2030, e-invoices offer several benefits:

Automates Invoicing Process

Digitising the invoicing pipeline means that invoices no longer need to be manually assembled and sent. Instead, these processes can be programmed to happen immediately when triggered by either manual input or a digitally.

This cuts down on unnecessary admin workflows and increases efficiency by allowing you to focus on higher-value tasks. According to one report 66% of finance teams are spending more than 5 days each month on invoice management (SCSE, 2021).

Reduces DSO

Days sales outstanding can be reduced through e-invoicing as it speeds up both the invoice dispatch and payment process. Research shows that digital invoicing typically reduced DSO by around 14 days annually (Seremet, 2021) simply by reducing the lag times in the regular process. This in turn reduces a company’s working capital cycle, which can benefit a business immensely.

Despite this, according to a survey, only 7% of organizations have an automated invoice solution. Moreover, 35% have no plans to switch to Automation Processing. This means that businesses that integrate automation quickly are likely to experience a medium to long-term competitive advantage over a majority of the market.

FinTech Accelerate the Benefits

Many companies are actualising these benefits through FinTechs who digitise the financial process entirely.

Through a symbiosis of fast-accessible invoice finance and automated digital processes, the commercial experience is vastly enhanced for all parties.

Finance your invoice to upscale your business to the next level.

Collateral-free

Flexible

Transparent

Velotrade finances corporate’s operations swiftly and asks for no collaterals.