A cash flow statement (also known as the statement of cash flows) is a financial statement that records all cash generated and spent during a given period.

This helps in determining how much cash a business has available on hand. When analysed with the balance sheet and income statement, a company’s cash flow statement gives us an outlook on its financial health.

![]() Highlights of this article:

Highlights of this article:

- What Comprises Cash Flow From Operating Activities?

The impact of non-cash expenses on Operating Activities - How Do Investing Activities Impact Cash Flow?

Effect of purchase and resale of long-term assets - How Do Cash Flow From Financing Activities Define a Firm’s Creditworthiness?

Find out how debt issuance is a cash inflow for future business growth - The Direct and Indirect Methods of Calculating Cash Flow

Which method is commonly used by businesses? Let’s find out! - 3 Financial Metrics For an Effective Cash Flow Statement Analysis

Determine your ability to pay short-term liabilities and true profitability - What Does a Cash Flow Statement Not Tell You?

Perks and limitations compared to other financial statements

Content

A cash flow statement includes cash movements from operating, investing and financing activities. Collectively, these three sections tell us the source of a company’s cash flow.

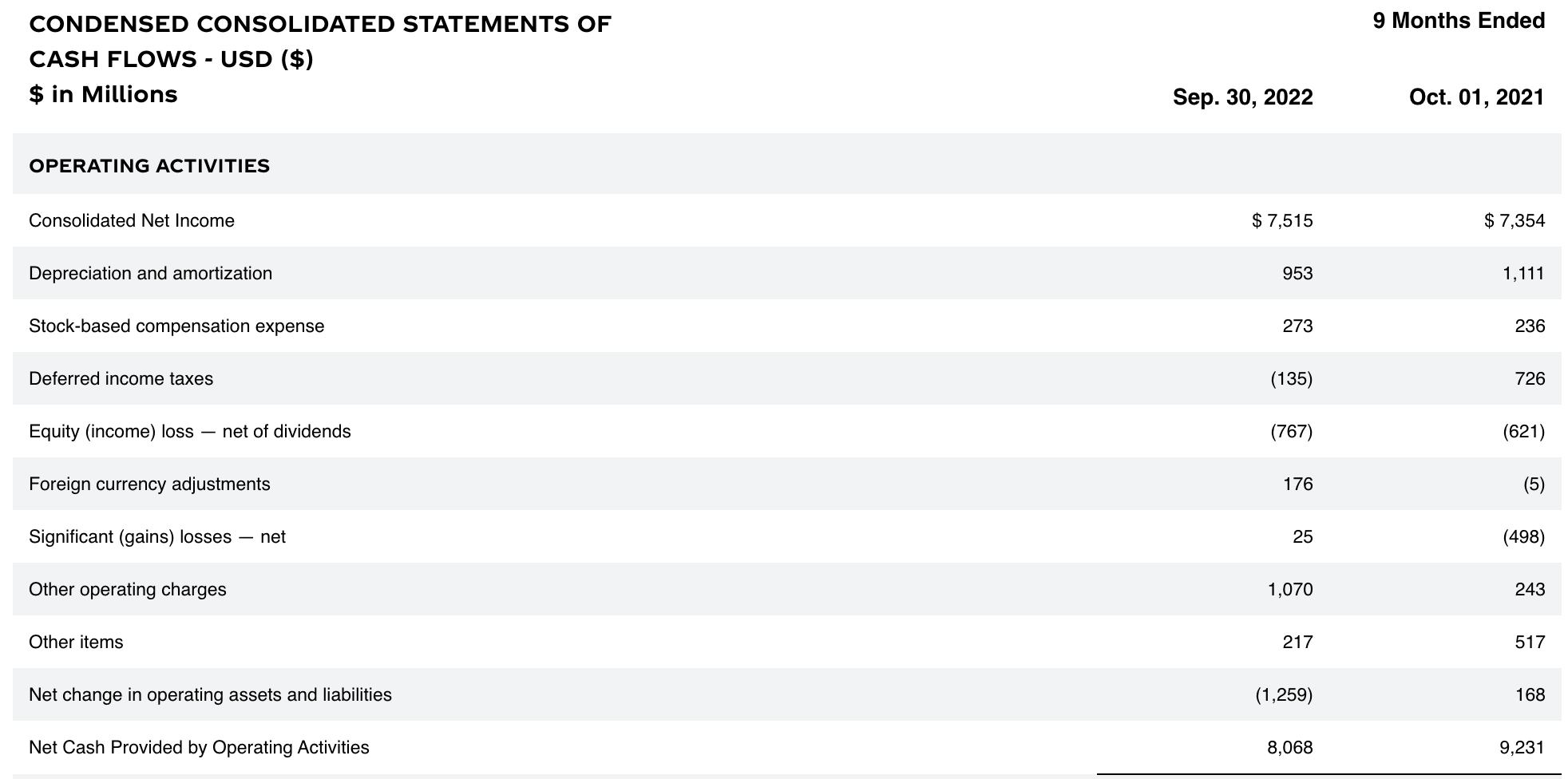

The key elements of each cash flow activity are explained below using Coca-Cola as an example.

Cash Flow Statement Operating Activities

This section includes all cash generated from a company’s daily core business activities, as seen in Coca-Cola’s statement below.

Some key elements to note are:

Net Earnings

The section starts by recording the profit or loss a company has incurred over the given period.

Simply speaking, it is a company’s income minus expenses.

Adjustments to Net Income

Following that are adjustments made to net income due to a firm’s operating activities, including:

- Any expense or revenue accruals, i.e. activity that has occurred for which cash has not been paid or received yet

- Depreciation of tangible assets like a car, property, or machinery

- Amortisation of intangible assets like copyrights, patents or goodwill

Depreciation and amortisation are added back to the cash flow statement as they are non-cash expenses.

Assets lose value over time. The life expectancy of tangible assets is difficult to calculate, while the duration of a given patent is well defined, i.e. 20 years. In order to reduce the outstanding value of the asset, a depreciation or amortisation expense is recorded annually, up to the end of the estimated duration or life of the asset.

Although the depreciation or amortisation is recorded as a cost, there is no physical outflow of cash involved in this cost. Thus, it is added back to the net profit in order to obtain the true cash value of a business.

Changes in Working Capital

Any changes in current assets and liabilities affect a company’s operating activities. This includes changes in accounts receivables, payables, inventory stock, or any other asset owned by a company.

This does not include long-term assets like stocks, bonds, property, equipment, or other investments. An increase in current assets due to equipment purchases depicts a decrease in cash flow. The company’s purchase of goods is a cash outflow.

An increase in current liabilities means longer credit repayment terms. This results in an increase in cash flow as the company is able to hold on to their money for a longer period of time.

The net cash provided by operating activities reflects the total amount of money once all the above adjustments have been made.

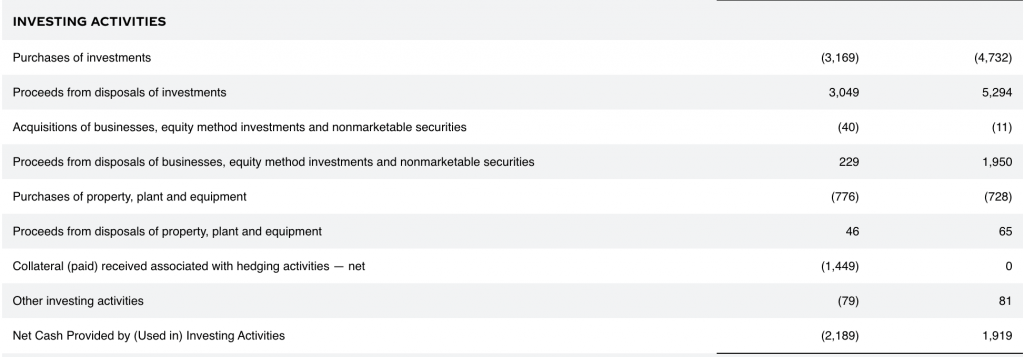

Cash Flow Statement Investing Activities

This comprises capital expenditures and long-term investment changes.

Transactions falling under investing activities include purchases or sales of property, plant, equipment, or marketable securities. A purchase results in a cash outflow and reduces the cash balance while a sale results in a cash inflow and increases the cash balance.

Whether it is purchasing property, equipment, or stocks, investors, analysts, and firms can see the source and areas of investments. This is important as it shows how the company is investing for its future growth.

After accounting for all investment activities, the net cash from investing activities is determined.

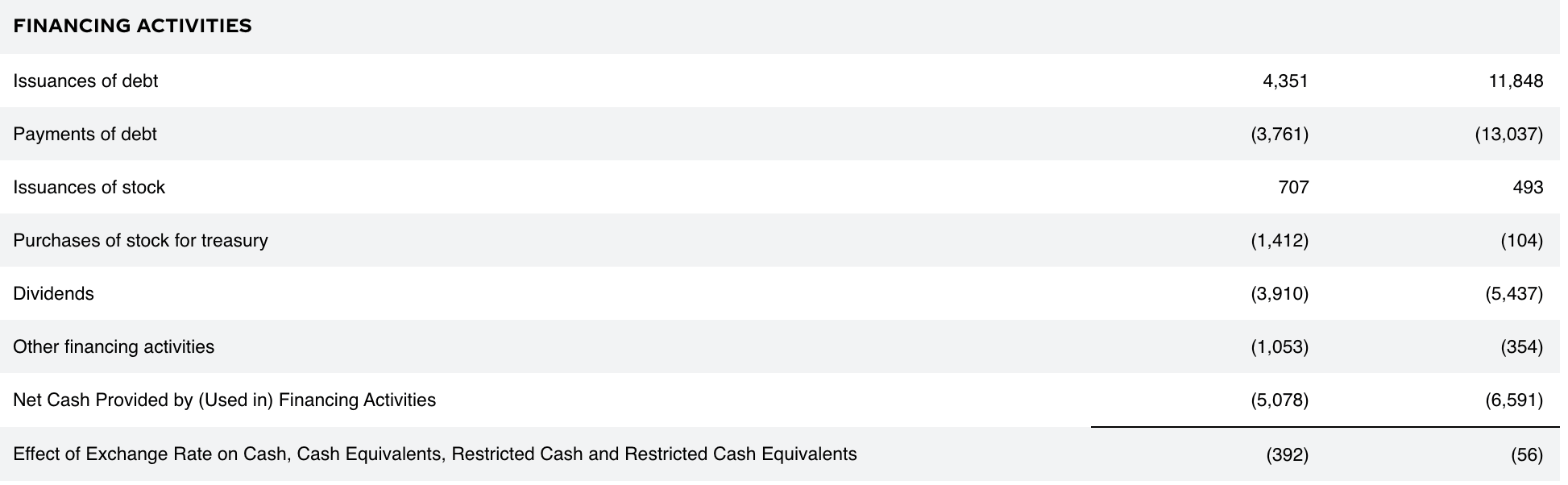

Cash Flow Statement Financing Activities

Since this indicates how a business funds its operations, it is essential for financial analysts, accountants, and investors to determine a firm’s creditworthiness. This includes issuance or repayment of debt and equity, financing capital assets, and dividend payments to shareholders.

Companies often finance operations by borrowing money or accessing funding from investors. This debt issuance is a cash inflow because a company finds investors willing to grant funds.

On the other hand, the ability to repay this debt determines a firm’s credibility and attracts investors to the company. This is a cash outflow in the cash flow statement.

The net cash by financing activities is the total cash flow from funding activities after taking new funding sources and repayment of debts into account.

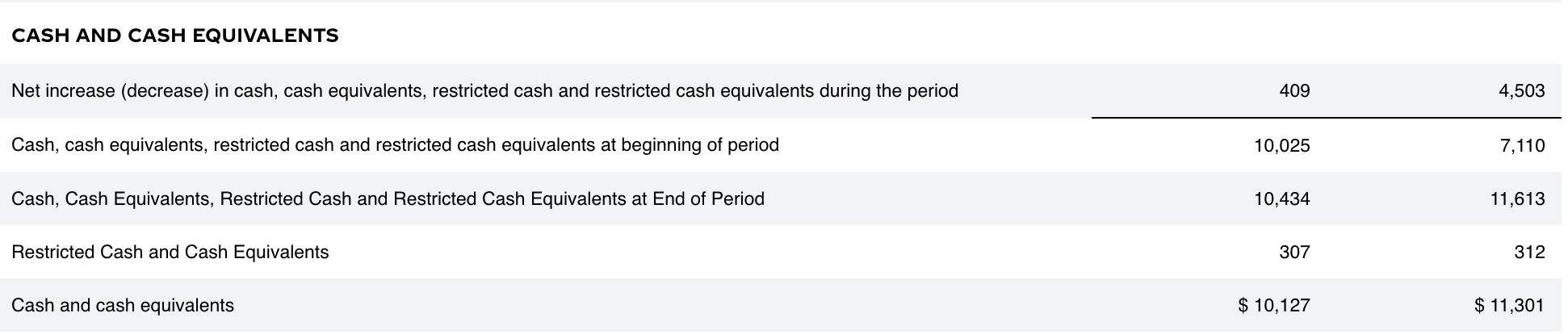

The final section of the cash flow statement is a reconciliation of the total cash balance, which connects to the balance sheet.

This indicates an overall net increase or decrease in cash flow once the total balance from the three sections has been summed up.

The closing cash balance becomes the opening cash balance for the next financial period.

Still unclear what these three activities mean? Read more about the three categories of cash flow activities to gain clarity on the definition.

Cash Flow Statement Calculation Methods

There are two ways for a company to calculate its cash flow:

Direct method – only considers cash transactions, ignoring all adjustments from non-cash expenses like depreciation

This is a less commonly utilised approach by businesses.

Indirect method – uses the net income as the base value

It is adjusted for all assets and liabilities changes, including changes in cash that occurred due to non-cash expenses.

Although less accurate and more time-consuming, this method is standard in the accounting industry as it timely accounts for all adjustments.

How to Analyse a Cash Flow Statement?

A cash flow statement works as a bridge between a balance sheet and an income statement. It aims at a short cash conversion cycle, ensuring receivables are converted to cash as quickly as possible.

A company may have negative cash flow, but one must analyse a cash flow statement in conjunction with other financial statements to gain an accurate picture.

Below are a few things to look for when analysing a cash flow statement:

Debt Service Coverage Ratio

The debt service coverage ratio measures a company’s ability to settle short-term liabilities. However, having greater liquidity does not necessarily imply that your business is booming.

A company might have lots of cash because it is mortgaging its future growth by selling off its long-term assets or taking on unsustainable debt levels. The debt service coverage ratio is calculated as follows:

Debt Service Coverage Ratio Formula – Indicates a firm’s ability to pay short-term debts

Debt service includes the principal and interest payment made on loan. A DSCR higher than 1 is considered good. It implies that the company has sufficient operating income to pay its current debts.

Whereas a ratio less than 1 implies the inability of a business to meet its debt obligations through its operating income fully. It may need to resort to personal funds to sustain and keep the company afloat.

A ratio above but too close to 1 is also not good either. This shows that the business may have just sufficient cash to meet its debts. A minor decline in cash flow may make them unable to pay their debts.

Thus, a company should aim to have a DSCR of at least 1 in order to ensure its long-term sustainability.

Free Cash Flow

Free Cash Flow is another crucial financial metric derived from a cash flow statement that measures a business’s true profitability. This is essential because it tells us the exact amount of cash a company has on hand available for use.

Read our definitive cash flow article to learn how to calculate free cash flow.

Unlevered Cash Flow

Unlevered cash flow is a company’s cash flow, excluding interest payments. It shows how much cash is available to the firm before considering financial obligations.

The difference between levered and unlevered cash flow shows if the business is overextended or operating with a sustainable level of debt.

![]() Key Takeaways

Key Takeaways

- Depreciation and Amortisation are Added Back to Operating Activities

Depreciation is recorded as an expense, but there is no ash outflow at the time. Hence, it is added back to determine the true net profit. - Cash Flow From Financing Activities Determine a Firm’s Creditworthiness

Debt issuance is a cash inflow as a funding source provides funds to the company, but repayment is a cash outflow. - Cash Flow Can be Calculated Using the Direct and Indirect Method

The direct method considers only cash transactions, while the indirect method includes non-cash expenses as well. - A Cash Flow Statement Must be Analysed Along With the Balance Sheet and Income Statement

The Debt Service Coverage ratio is an important metric as it determines a firm’s ability to pay short-term debts.

Advantages and Limitations of Cash Flow Statement

The table below summarises a cash flow statement’s key advantages and limitations.

| Tells a company’s true cash position | Cannot deduce the profit or loss of a company by solely looking at a cash flow statement |

| Cash Flow projections help firms prepare for cash shortfall | Only addresses the cash position over a specific period |

| Helps identify discrepancies between cash flow statement and balance sheet | Does not provide substantial information about a firm when analysed in isolation |

| Effectively manages cash surplus, enabling firms to plan constructively | Inaccurate projections could lead to bad business decisions |

Regardless of its limitations, a cash flow statement is the ultimate indicator of a business’s true cash position.

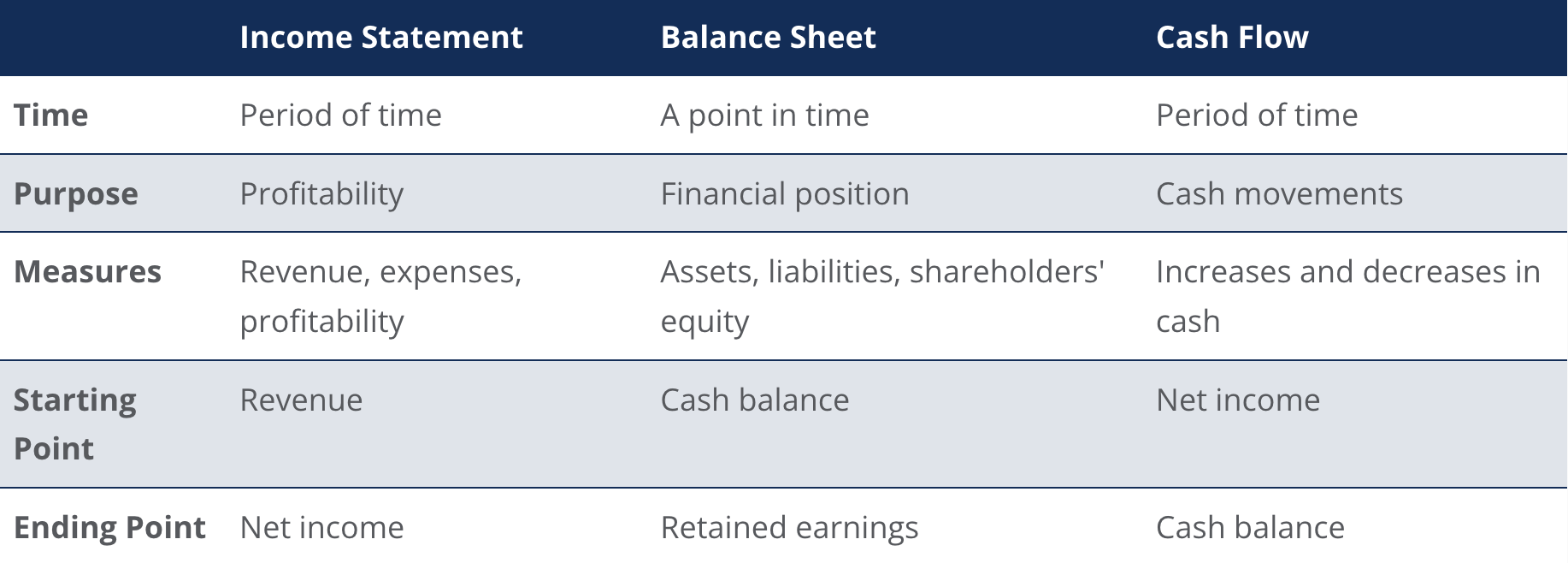

Income statements tell you how much money your business has spent or earned over time, while a balance sheet indicates how these transactions affect your assets and liabilities at a given point in time.

Key features of the three core financial statements of a company.

However, these statements do not tell you how much cash you have had on hand for a given period. This is when the cash flow statement comes into play!

A business must therefore ensure to analyse and manage cash flow efficiently and accurately.

Velotrade finances corporate’s operations swiftly and asks for no collaterals.