In simple words, negative cash flow is when there is more cash leaving than entering a business.

This is common with new businesses that have high start-up costs and take time to generate cash inflows that exceed investments.

Understand all about negative cash flow through this article to know when it is a good or bad sign for your business.

![]() Highlights of this article:

Highlights of this article:

- Understand Negative Free Cash Flow

Is it Good or Bad For Your Business? Find out here! - When is Negative Cash Flow Good?

Learn the type of negative cash flow to know when it is a bad sign - Netflix and Amazon Case Studies

The success behind their negative cash flow

Content

Having a negative cash flow does not always imply a loss for a business. However, a business that continuously experiences negative cash flow will eventually fall into serious issues.

What Does Negative Free Cash Flow Mean?

When there is no cash left over after meeting operating, capital, and adjusting for non-cash expenses, a company has negative free cash flow.

This means that the company has no excess cash on hand in a given period, which could be a sign of poor financial health. Low revenues and high capital expenditures are common reasons why.

Let’s dive in with an example.

Company A earned $200 million during the second quarter. It incurred $5 million in income tax. Hence, the net operating profit after taxes was $195 million. After accounting for the non-cash expense – a depreciation of $20 million, the company’s cash flow from operating activities went up to $215 million.

The company however also spent $250 to acquire new fixed assets in the form of capital expenditure during the quarter. This led the company to incur a negative free cash flow of -$35 million.

| EBIT | $200M |

| Tax (2.5%) | ($5M) |

| Net Operating Profit after Taxes | $195M |

| Depreciation | $20M |

| Capital Expenditures | ($250M) |

| Free Cash Flow | ($35M) |

So, does this mean the business is performing poorly?

Not necessarily!

Young companies are likely to report negative free cash flow due to constant reinvestments to finance growth. Such negative free cash flow is good if these reinvestments accelerate revenue and increase margins in the near future.

As a result, to determine whether negative free cash flow is a good or bad sign for your business, one needs to assess the following situations:

- Which stage of the corporate lifecycle is your business currently at?

- What is the cause behind its negative free cash flow?

- What kind of capital investments is it making?

- What is the funding source?

Know what is free cash flow and how to calculate it if you are clueless!

Why is Negative Cash Flow Not Always Bad?

A business could make net profit while having negative cash flow.

Earning revenue does not necessarily mean that the company has received cash immediately. The actual movement of cash may happen later.

For instance, a company sold goods and accrued profit on the income statement but did not receive the money yet. In this case, the customers agreed on a payment term of 60 days and will therefore pay 60 days later. This could also be due to operational issues.

Late payments from clients lead a company to incur losses in one month and profits in another. Also, a business may be making a profit, but its money could be tied in accounts receivables or hard assets. Besides, several mistakes and financial hurdles can cause companies to spend more than earn.

To know what causes negative cash flow, one must know some cash flow problems commonly faced by businesses.

So, when is negative cash flow bad for a business? To determine this, one needs to identify the type of negative cash flow that they are facing.

Three Types of Negative Cash Flow

Companies may face different types of negative cash flow depending on the situation or company size.

- Initial Negative Cash Flow

As the name says, this is common with new and growing businesses that often invest heavily in resources to increase brand awareness and authority in their respective market.

This can lead them to have excessive cash outflow, but these investments may offer high returns in the long term. This is a good sign for investors who seek companies offering high returns.

Since this kind of negative cash flow is temporary, it would not be a negative sign for a business.

A new company has several cash outlays and capital expenditures to develop its business operations. Many rely on loans or investments to fund their projects. Hence, it is totally possible for a growing company to have negative cash flow in its infancy.

Once the customer base is established, the company’s inflow should begin to exceed its outflow.

- Temporary Negative Cash Flow

Aside from initial negative cash flow, businesses may also incur negative cash flow for a temporary period during their operation.

Once the business is established, healthy, and profitable, the company may adopt an expansion strategy. To deploy this strategy, they may have to increase salaries, hire new employees, provide dividend growth to shareholders, and incur other overhead costs.

These additional costs could lead the business to incur negative cash flow but usually only for a short period.

Additionally, some businesses that experience seasonal growth may also incur temporary negative cash flow. Retail businesses with slow growth during low demand seasons and heavy merchandise purchasing for peak seasons commonly experience this.

- Chronic Negative Cash Flow

When an expansion cannot explain a negative cash flow, then there is something to be concerned about.

If a company is constantly reporting negative cash flow, it is either overinvesting or losing money over time which is certainly not a good sign. This can lead to unpaid bills and increased layoffs.

If the root cause of the problem is not addressed immediately, then it is unlikely for the business to sustain in the near future. Such negative cash flows can be highly damaging to a company’s business.

Thus, maintaining profit is not enough. Having a steady flow of cash is equally important. However, it would be wrong to judge a business’s success by merely looking at its negative cash flow.

![]() Key Takeaways

Key Takeaways

- Negative Free Cash Flow is Not Always Bad

This is when the company has no cash left after meeting all expenses, but this could also be due to heavy reinvestments. - A Business Can be Profitable While Having Negative Cash Flow

To determine whether negative cash flow is bad for your business, one needs to know the 3 types of negative cash flow. - New Companies Often Experience an Initial Negative Cash Flow

This can be due to heavy capital investments and expenses that are essential for a company’s growth. Since this is mostly temporary, it is not a sign of worry. - Established Businesses May Also Experience Temporary Negative Cash Flow

Business expansion, seasonal demands, unforeseen market situations can be reasons why! - Chronic Negative Cash Flow is a Sign of Worry

This is when firms consistently report negative cash flows due to losses or over-investment.

Negative Cash Flow Examples

You won’t be surprised to see big company names when speaking of negative cash flow.

Netflix and Amazon are 2 of them.

Although their cash flow statement may give negative implications, upon deeper analysis, we learn the situation is otherwise.

Let’s read further to find out how!

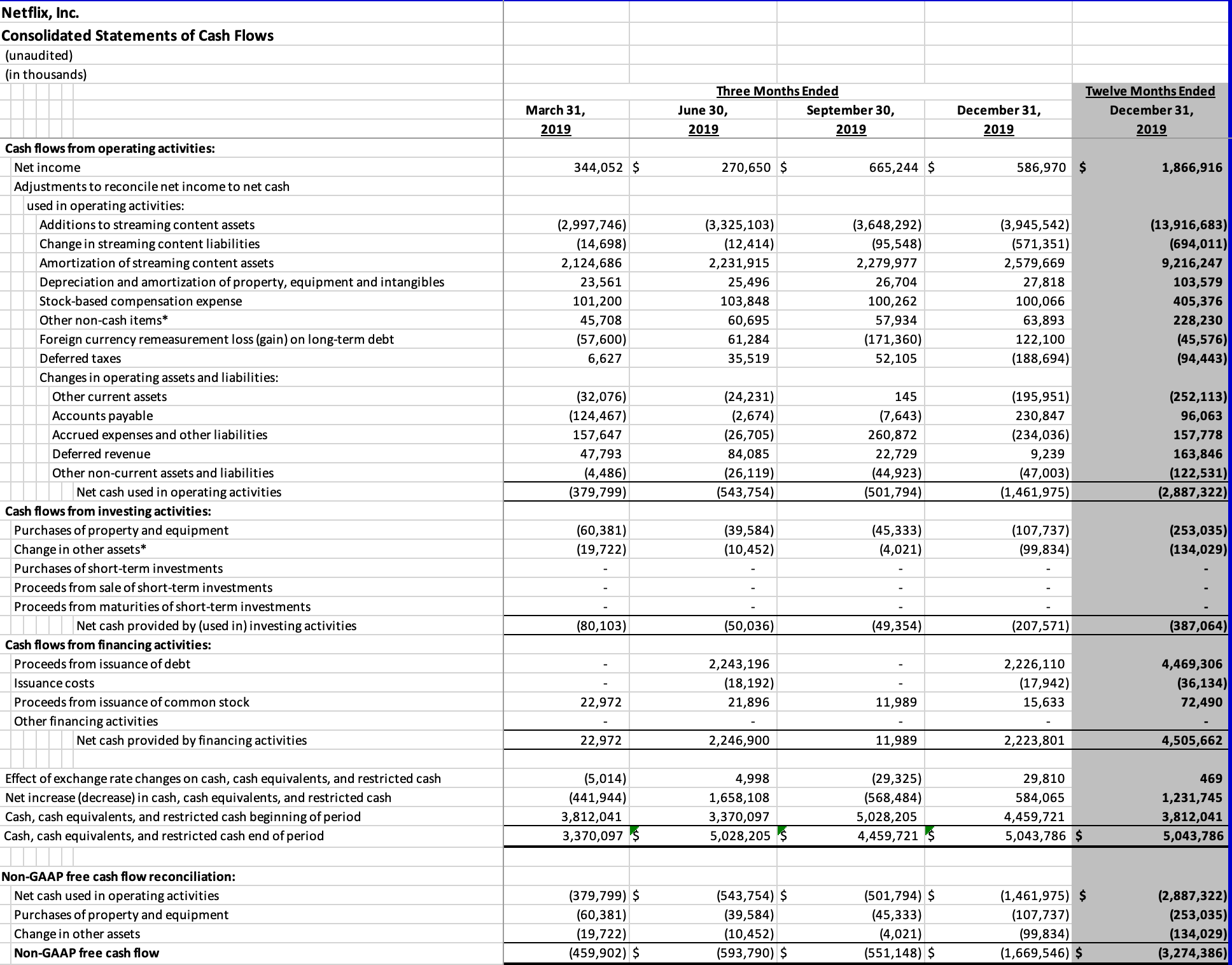

Netflix – Its Growth with Negative Cash Flow

Netflix has been reporting negative cash flow in the past few years, mainly in 2019.

With the launch of other streaming platforms like Disney+ Hotstar and Apple TV+, the subscriber rate of Netflix decreased.

This led Netflix to grow its streaming collection to remain competitive in the market. Therefore, the cost of creating new content assets increased, taking a toll on Netflix’s negative cash flow.

Also, Netflix increased its investing activities during that period which further led to negative cash flows.There was a lot of buzz around Netflix having a cash burnout at the time in the market. Investors started losing confidence and Netflix was relying heavily on debt to finance its investment activities.

However, the management was confident that it will recover costs and close this cash gap in the upcoming 2 years. So, this cash imbalance was essential, according to Netflix, for it to gain profit in the later years. The extra cost involved in purchasing new assets should pay off in the coming years through an increase in subscribers.

Analysts also forecasted Netflix to become more profitable in international markets for the same reason. This was evidenced in 2020 itself as the company started incurring positive net cash flows.

With a 159.39% increase from 2019, it had an annual net cash flow of $3.195 billion in 2020.

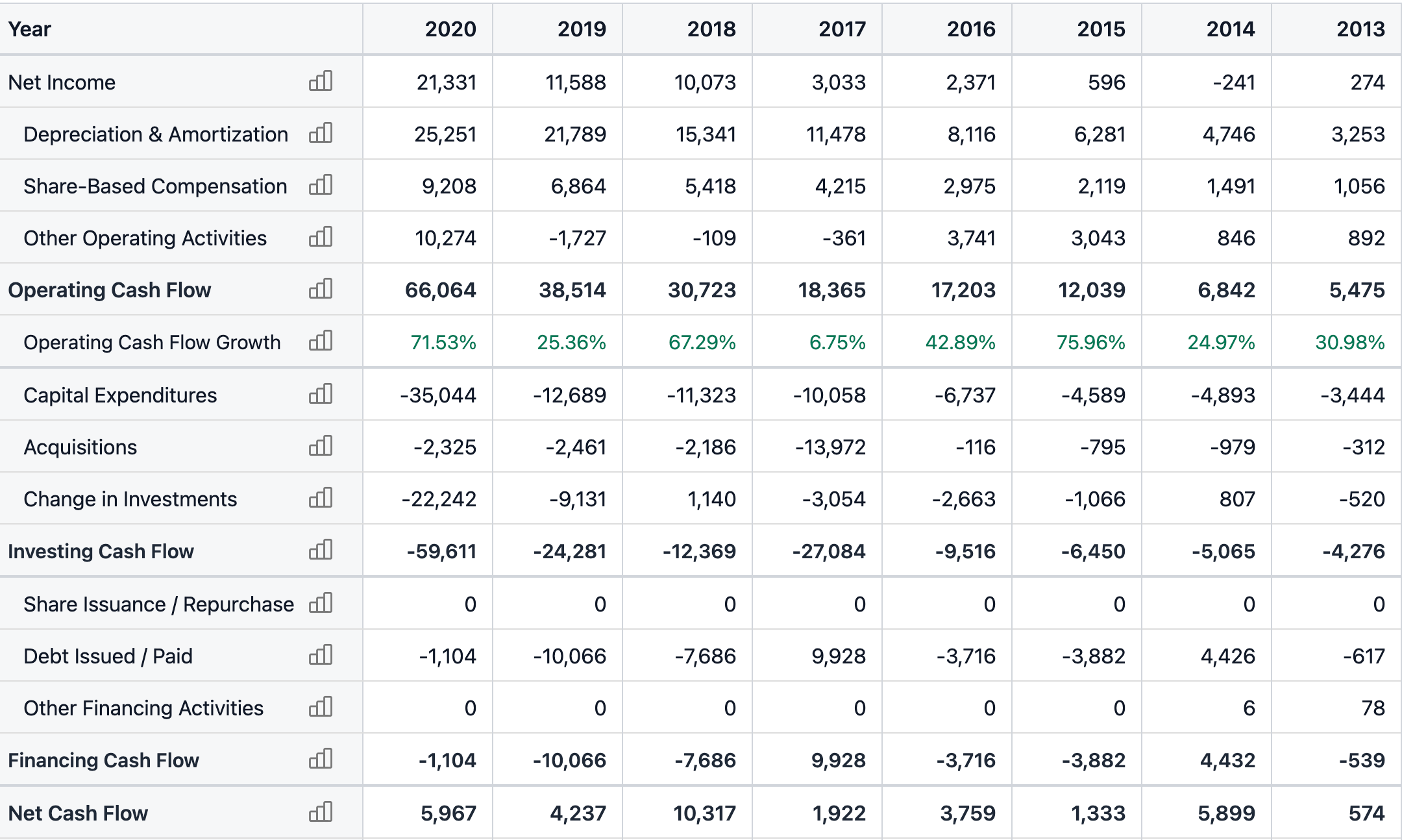

Amazon – The Reality Behind its Negative Cash Flow

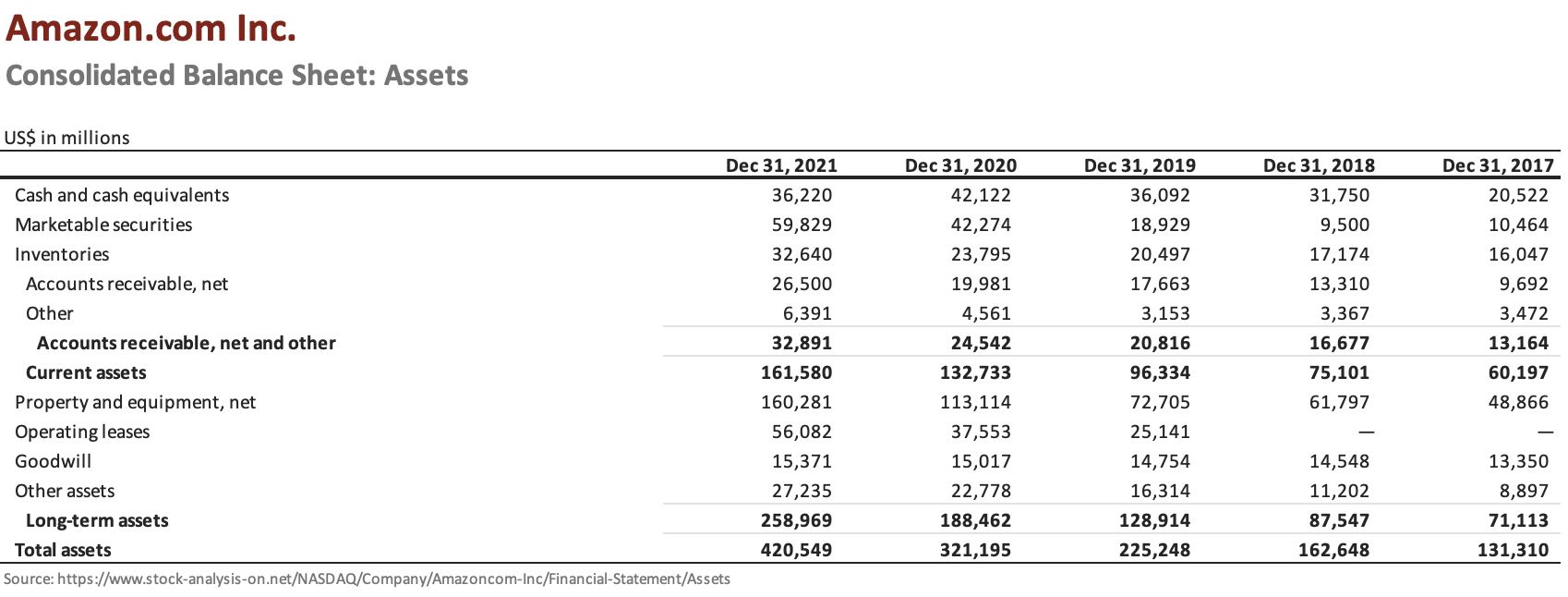

This eCommerce giant has also been incurring negative cash flow from financing and investing activities over the past few years as can be seen in the statement below.

To balance this large cash outflow, the company has been further financing through debt to inject liquidity.

Amazon’s situation may seem alarming at first but it is only upon deeper analysis that we find out why this is not the case. The major reason behind Amazon’s negative cash flow is its high capital expenditures and reliance on debt. However, this is simply because it reinvests its profit rapidly in innovative products.

Amazon intentionally keeps its profit low through internal investments like expanding its distribution network, building data centres and creating new lines of businesses like AWS cloud computing. This drive for constant innovation and expansion is what has also attracted growth investors to invest in the company.

The company further benefits from low profit through lower taxes. As a result, its free cash flow is incredibly high.

Upon looking at its balance sheet, we can see the company has an ample amount of cash and liquid assets available on hand.

While the company was reporting negative cash flow from investing and financing activities between 2018 to 2020, its cash and liquid assets were increasing.

Amazon’s payment cycle allows it to receive payments much earlier than it pays its suppliers, lowering its cash conversion days. So, it has more money coming in before the last quarter’s bills are due, keeping its free cash flow always higher.

Jeff Bezos considers free cash flow as the ultimate financial metric to evaluate the company’s financial success, mainly due to 2 key reasons:

- The cash available on hand enables Amazon to do more than it could otherwise. Aside from paying its suppliers, employees, and shareholders, the company uses this cash to invest in its future.

- Investors believe this to be a better valuation of a company’s stock than profit, determining its financial health.

Behind Amazon’s low profit and negative cash flow is a story of success.

These real business cases teach us how a cash flow statement alone is an inefficient and inaccurate representation of a company’s true profitability and performance.

If companies obtain financing while their cash flows are healthy, they can plan and prepare better for future expenses, instead of doing so after their cash flows are already negative.

Therefore, implementing strong cash flow management strategies is important for businesses to avoid negative cash flows.