A purchase order (PO) is an official document issued by a buyer detailing the goods or materials to be purchased by the seller. It’s a green light for the seller to provide the agreed goods or services at the specified prices.

For sellers, the PO is vital as it assists in determining the amount needed for financing procurement.

![]() Highlights of this article:

Highlights of this article:

- Purchase Order Requirements to Access Financing

What elements are the essential golden ticks? - Purchase Order and Invoice – How are the 2 different?

Unlock the key purposes and elements of each - Digital Purchase Order Systems for an Efficient Trading Cycle?

How can FinTech amplify the benefits?

Content

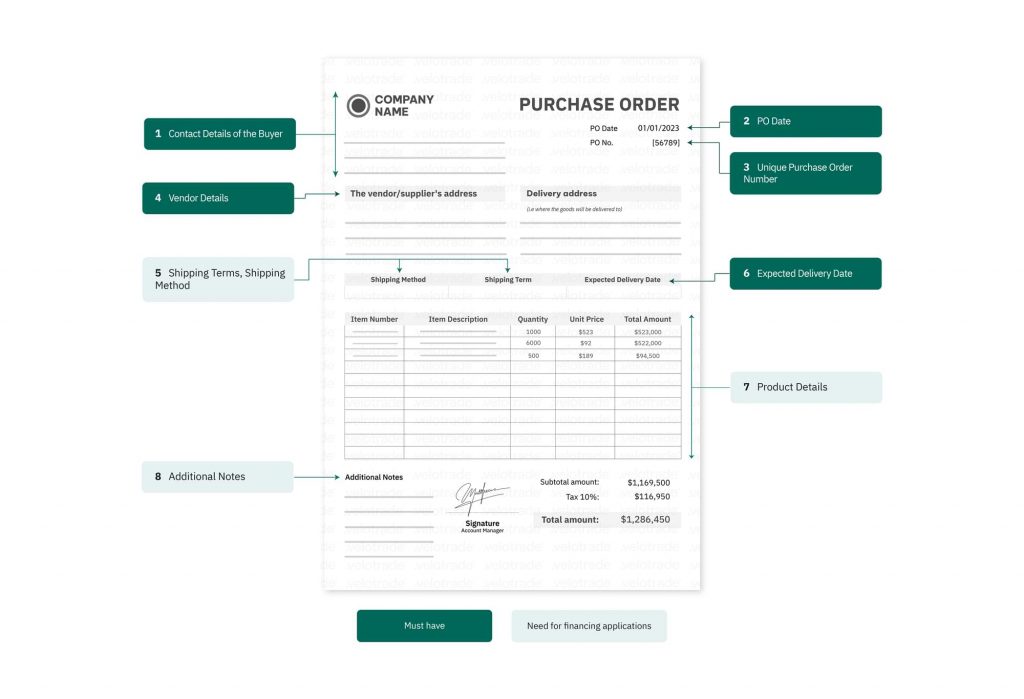

So, what should a purchase order include to ensure seamless financing? Let’s find out!

Purchase Order Format for Financing Applications

A purchase order isn’t just a request for goods; it’s a cornerstone document for accessing financing. Let’s get started with the essentials.

Every PO must have:

Contact Details of the Buyer: This includes the full name, shipping address, and contact information.

Vendor Details: The supplier’s full name, billing address, and contact information must also be included. This may be a person or an organization.

Unique Purchase Order Number: This unique identification number helps track the status of orders and deliveries.

PO Date: This is the date when the purchase order is created.

Expected Delivery Date: An estimated date of arrival of the goods to the destination, i.e., by when the order must be fulfilled.

But hold on! For financing applications, you’ll need more than just the basics:

Product Details: A meticulous description of the product along with the quantity, product SKU or model number, unit price, and the total cost is useful to make sure nothing is damaged or missing.

Shipping Terms: Incoterms must be specified to define who bears the transport costs and risks. Crystal clarity here will save you a headache later!

Shipping Method: The mode of goods transport should be included to keep the buyer aware of any risks that may affect delivery speed.

Additional Notes: Any extra information that’s relevant must be added here.

Remember, both parties must approve the purchase order for it to be a legally binding contract. The more comprehensive it is, the quicker and smoother the credit assessment will be.

Check out this sample purchase order template for reference!

Purchase Order vs Invoice

So, what is the difference between a purchase order and an invoice?

A purchase order is the starting point of the procurement process outlining what, how much, and under what conditions the goods must be delivered. In contrast, an invoice is the finishing line of the purchase, confirming what has been supplied and how much is owed.

Both documents are crucial in maintaining a smooth flow in trade transactions. Understanding and effectively managing these can significantly impact business efficiency and relationships with trading partners.

Purchase orders and invoices are siblings in the trading world, but they are not twins. These two documents play essential roles in the buying and selling process. Let’s explore their differences in a bit more detail:

Purpose

A Purchase Order (PO) kickstarts the pre-shipment process, allowing businesses to procure goods and set the wheels in motion for financing imports. The main purpose of a PO is to request approval on the terms of purchase and to keep track of the order progress.

On the other hand, an invoice is like a reminder note from the seller to the buyer, saying “It’s time to pay up.” It is issued after the goods have been delivered or services have been rendered. It contains the agreed-upon prices from the PO and is used post-shipment to finalize the transaction and record the sale.

The essential purpose is to confirm order details, payment terms, and help the seller track sales records, which are indispensable for inventory management and accounting.

That is not all. Check out the other uses of an invoice to fully understand its purpose and function for businesses.

Key Elements

While both documents must clearly state the order details, product specifications, buyer and seller contact information, and shipping terms, an invoice must refer to the PO for the agreed upon pricing.

It is important to link the invoice back to the PO by mentioning the PO number to ensure that that terms in the invoice correspond to what was agreed in the PO.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

Wondering what is the invoice document used for? Have a look at our extensive guide!

Purchase Order System to Streamline Trades

Are you still managing your orders on paper? In the digital age, a purchase order system is like having a superpower!

Did you know that companies with a purchase order system reduce processing costs by 50-80%? Plus, there’s a significant reduction in order errors and delays!

Talk about a game-changer.

Here are the amazing things a PO system can do for you:

A Database of All Past Transactions: Say goodbye to sifting through files. Every order, approved or rejected, is a click away.

Increases Efficiency: Automated details, calculated costs, instant tracking – it’s a whirlwind of efficiency!

Improves Order Accuracy: No more human errors messing up your documents.

Better Stock Planning: All the information about stock levels, reorders, and returns at your fingertips for smart planning.

Seamless Integration with Digital Financiers: Partnering with digital lenders is a breeze when your purchase order management is digitized. Combine the lightning speed of FinTech with your streamlined purchase order system and witness efficiency skyrocket!

In this fast-paced world of trade, a digitized PO system is not just an option; it is a necessity. A purchase order is your golden ticket to not only procuring goods but also securing essential financing.

Velotrade’s digital purchase order financing solution can further elevate your business with efficient capital sourcing that expand your trading capacities.

Collateral-free

Flexible

Transparent

Velotrade finances corporate’s operations swiftly and asks for no collaterals.