Support Your Sales

eCommerce Financing

Helping merchants worldwide meet capital needs to expand the business and optimise ops.

Grow with Cash Flows

Take care of your capital needs fully. From procurement to post-shipping, in the way you need.

Maximise Operational Efficiency

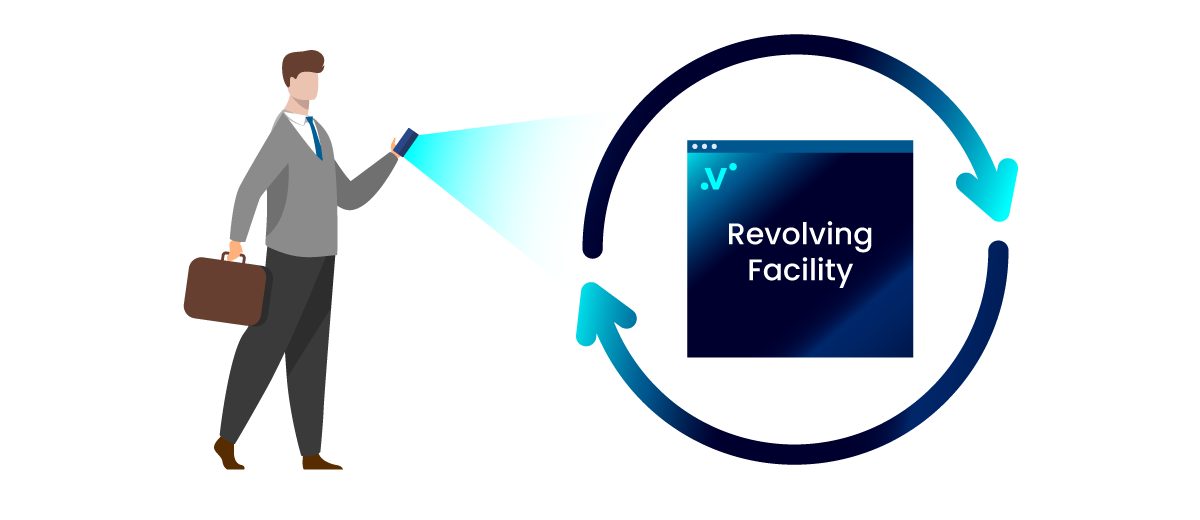

Settle costs before the marketplace pays you

Support Cross-border Trades

No Collaterals

All-online Process

Finance now to prevent the next stock-out loss.

Solutions for Your Needs

Each company is different. We pay attention to the nuances.

We approached Velotrade back in 2019. Since then, we have successfully obtained e-commerce financing with terms and conditions that would have been impossible with a conventional bank.

Consumers Electronics

Europe

We registered multiple stores on Amazon, with a payment period of 7 – 14 days. We obtained a 60-day revolving facility from Velotrade based on our monthly turnover, which is very helpful in shortening our cash cycle.

Cross-border eCommerce

Hong Kong

As a former client, we knew the benefits of financing with Velotrade. Upon acquiring the eCommerce brand, we access eCommerce financing for the reorganisation of the acquired company.

E-watch Manufacturer

Hong Kong

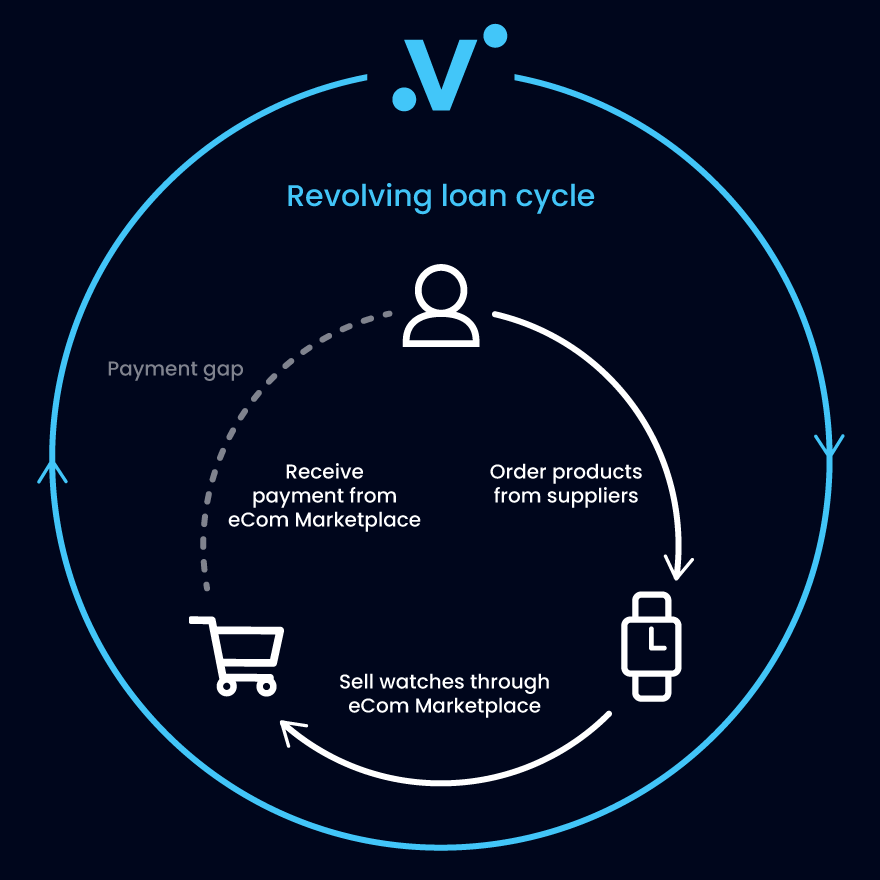

Support eCommerce Business Cycles

Case Study

The client has been an OEM for watches for decades, serving more than 300,000+ Customers digitally. Sales include both B2B and B2C channels.

Exporter: Smart Watch

Based in Hong Kong with most buyers in China

PROBLEM

The client pays cash in advance to source the watches from China, which are then sold on Shopify.

However, Shopify settles the payment to the client by the agreed payment term only. This causes a big cash flow gap between the time the client sources and gets paid.

SOLUTION

In less than 2 weeks, the company had a credit line of USD 130K on a 60-day basis. This additional liquidity helped the company deliver larger shipments.

Seamless Experience

Professional Team & Top-notch Technology

API-enabled for easier and faster process. Connect to your analytics to reduce paperwork

Full technical and client support: Hotline, Live Chat and FAQs available.

Securely developed in-house. Our team continuously manage updates to protect all users.

Eligibility

At least US$25,000 monthly revenues

on Amazon or other eCommerce marketplaces

Seasoned Merchant with Good Ratings

with at least 6 months of selling history on the marketplace

Regular eCommerce Transactions

with shipping continuity record, i.e. there should not be intermittent shipments of the goods

Low-cost Funding at APR 9-12%*

*USD equivalent

*Subject to credit assessment

FAQs

Still not sure? Talk to us>

display none

Why eCommerce Financing with Velotrade?

eCommerce Financing is a fast & cost-effective funding solution for merchants selling online.

Understanding the nature of eCommerce businesses, Velotrade eliminates convoluted document review processes and does not require any collateral for application.

Expand your eShop and grow your business with Velotrade’s eCommerce financing solution.

Consult now, see how we can help.

What are the fees?

The only cost is the daily interest until you repay, as low as 0.033% per day. There are no any other costs – no handling fees nor early repayment costs.

I need a long-term loan. Is this suitable for me?

The offer is highly flexible and recurring – you can apply additionally based on your operation needs and business model. So, technically the offer can be as long-term as you prefer!

How are eCommerce businesses supported?

eCommerce businesses, especially SMEs, are exposed to cash flow pressures, from rising fulfilment costs to global supply chain disruption.

Velotrade’s trade finance experts look into each case carefully to understand your needs and provide the best fitting solution possible.

We offer maximum flexibility which is otherwise not possible by traditional institutions.

Awarded & Recognised

“Winner of Tech Challenge”

“Enhance operational effectiveness”

“Addressing the trade finance gap”