Working Capital Financing is when a business borrows money to cover day-to-day operations and payroll rather than purchasing equipment or investment. Working capital financing is common for businesses with an inconsistent cash flow.

![]() Highlights of this article:

Highlights of this article:

- Achieve Optimal Business Growth

Learn the benefits and importance for businesses - 4 Different Ways to Finance Your Working Capital

Whether its Loans, Overdraft, Line of Credit or Invoice Discounting find it out here! - 3 Working Capital Financing Strategies

The most applicable approach depends on the surroundings and the risk profile of the business - Finance your Working Capital with Us!

Velotrade offers working capital solutions to help businesses maintain a steady cash flow for sustainable growth

Content

Companies from every industry use working capital financing to expand and scale up.

For example, a large business with steady cash flow may apply for a working capital loan to finance the expansion of operations into a new region. In this instance, the loan will act as a buffer until the new region becomes self-sufficient. Similarly, a small business may require working capital finance to bridge the gap between cash inflows and outflows while the business grows.

Importance of Working Capital Finance for Businesses

Whether your business is facing cash flow issues or not, having extra cash in reserves is always good to secure yourself during unexpected circumstances.

Working capital financing lets firms fulfil their short-term or urgent cash flow shortfalls.

Benefits of Working Capital Financing

This financing option is beneficial for different business types and purposes. Below are key benefits of working capital financing:

Cover Expenditure Gaps

Working capital financing helps keep a business afloat by financing its payment gaps and fulfilling its working capital requirement.

Small and growing businesses solely relying on accounts payables to fuel their working capital can support their everyday operations without the need for an equity transaction.

Zero Collateral Requirement

Firms with good credit ratings are granted unsecured working capital finance. They do not need to forfeit any collateralised assets in the event of default.

The ability to access zero collateralised financing enhance the business’s credibility.

Faster and Flexible

Since businesses usually seek working capital financing to meet their immediate cash flow needs, lending institutions need to process it quickly.

Financiers must understand:

- The significance of quick financing and the need for businesses to revive their operations quickly.

- Flexible repayment terms.

- Interest rates may vary depending on the risk associated with the industry and the business model.

Positive Impact on the Turnover Ratio

To fully understand the benefits of working capital financing, one needs to be familiar with working capital turnover ratio first.

Working capital ratio indicates how well the business meets its current obligations. It also shows how much working capital financing it will need moving forward.

However, this is not the financing option to go for if you do not have the cash flow to meet periodic payments.

If your business has an unproven track record, pursuing a collateralised contract may still be the dominant strategy until your credit rating improves.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Gain a clearer picture on the practical benefits through a working capital financing business case which shows how the facility helped a leather trader.

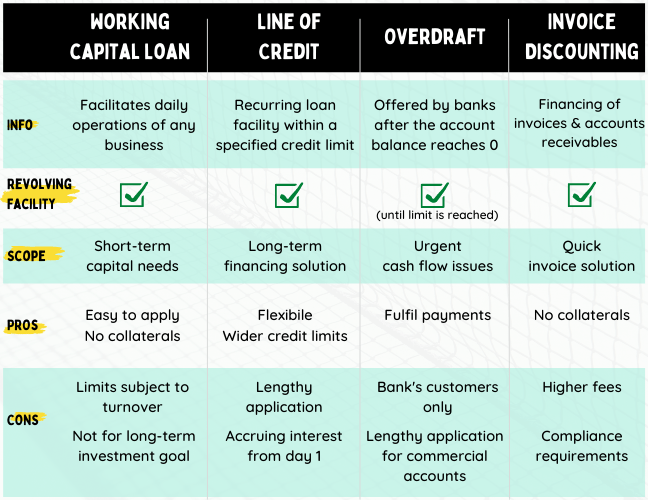

4 Types of Working Capital Finance

There are several ways of financing working capital. The most common are:

Each have their advantages and disadvantages.

However, some are easier to get approval than others as banks can ask for huge collateral coverage depending on your businesses’ credit status.

Pros and Cons of the 4 Working Capital Financing solutions

Working Capital Loan

Very simply, a loan taken to finance daily business operations.

For example, a business applies for a loan to cover the rental cost of the premises. Renting a premise would indirectly generate enough yield to pay the loan by maturity.

One of the drawbacks of a working capital loan is that it must be taken out again each time. For this reason, a working capital loan makes it a poor long term working capital financing solution compared to alternatives. Hence, not effective for businesses experiencing frequent cash flow shortage. The size can vary wildly – generally between $2,000 to $5 million.

Overdraft

An overdraft is always offered by the institution providing the corporate bank account. Alternatively, any third-party institution can provide a revolving credit facility.

For the bank account holder, an overdraft behaves the same way as a line of credit. If your account balance dips below zero, the bank provides you overdraft protection up to a certain amount. This prevents your purchase from being declined and your cheque from being bounced.

Overdraft protection can be linked to a business account but is typically utilised by individuals. While personal bank accounts will come pre-equipped with an overdraft facility, businesses must apply for overdrafts on commercial accounts.

Overdraft is very similar to a line of credit but this is a non-revolving form of credit.

Line of Credit

This is a loaning facility granted by a lending institution allowing a business to borrow and repay as often as needed within a set limit.

It is a long-term and flexible working capital financing solution.

For example, a business is granted a line of credit for the year. The company borrows and repays 60% of the allotted amount monthly.

Let’s assume the business picks up in the summer and needs to borrow a higher amount from its line of credit.

A credit line allows the business to:

- Use credit facility when needed

- Have a lower interest rate compared to one off bank loans

This is because a line of credit only accrues interest when debt is taken out on it.

Invoice Financing

This working capital financing solution for small and medium-sized businesses is easier to get compared to other financing methods.

Why? Because it is backed by an asset, the invoice.

For example, if a business has an invoice that is not payable yet, invoice financing can help bridge the gap and make the funds immediately available. Gain a deeper understanding of how invoice financing works through our conceptual article that expands on the concept.

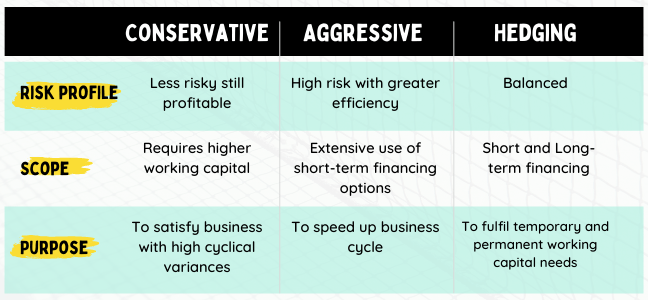

Three Working Capital Financing Strategies

Just as there are different types of working capital financing, different strategies and approaches can be used to manage the working capital of a business.

The most applicable approach will depend on the specific circumstances surrounding your business.

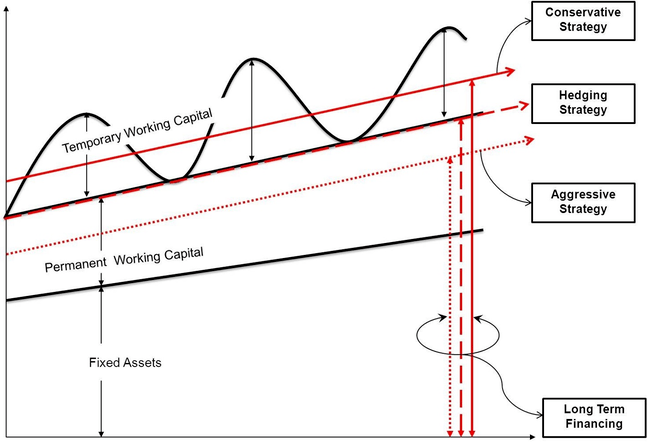

Below are three working capital strategies businesses should adapt based on their credit score, industry, business size, working capital turnover ratio, and financial goals:

Working Capital Strategies depend on the company profile

Conservative Approach – As the name speaks for itself, this strategy finances working capital with low risk and profitability.

Working capital financing will primarily be secured through long term solutions in these instances. For example, equity funding, term loans or long-term securities like debentures.

This strategy also finances a portion of your temporary working capital. Temporary working capital is the net working capital variation curve above permanent working capital.

Companies with high cyclical variances such as tourism or farming may adopt this approach.

This methodology helps buffer against insolvency risks.

Aggressive Approach – Conversely, an aggressive approach involves extensive utilisation of short-term financing options.

An aggressive approach aims to speed up your business cycle and reduce idle assets that generate unnecessary costs.

Although there are efficiency advantages associated with this approach, it is incredibly high risk compared to a conservative strategy.

Hedging Approach – Perhaps the most sensible, utilitarian and most frequently adopted approach.

This involves using long term financing methods to account for fixed assets and permanent working capital.

The graphical representation below, gives you a better understanding of how the three working capital strategies work.

Long- and short-term strategies are used to overcome temporary and permanent working capital needs.

Conservative, Hedging, and Aggressive, are working capital financing strategies used by companies

There is no universal financing solution, so make sure you understand your circumstances before formulating a plan for your business.

A business needs to understand its working capital at every stage of the business cycle.

Working Capital Funding Sources

Once you understand your working capital requirements, you may wonder where to go for financing.

Numerous financial institutions are offering the different working capital financing facilities explained above.

From more traditional banks and financial institutions to angel financing schemes and alternative financiers, the options available may be overwhelming.

FinTech financiers like Velotrade are transforming the trade finance industry through their digitised business models.

Velotrade aims to improve against convoluted and inaccessible systems by utilising a fully digital, highly intuitive, and easy-to-use platform. The process requires no collateralisation of assets to secure financing.

Velotrade offers working capital solutions to help businesses maintain a steady cash flow for sustainable business growth.

Whether you are an eCommerce, import & export, retail, or supply chain business, we help a wide range of industries meet their working capital financing needs.

Hassle-Free

Paper-Free

Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions.