Iceberg /ʌɪsbəːɡ/ – noun: iceberg; a large floating mass of ice detached from a glacier or ice sheet and carried out to sea; approximately 10% of an iceberg is visible to the naked eye.

Illusion /ɪˈluːʒ(ə)n/ – noun: deceptive appearance or impression; a false idea or belief.

Content

What it Means to Investors

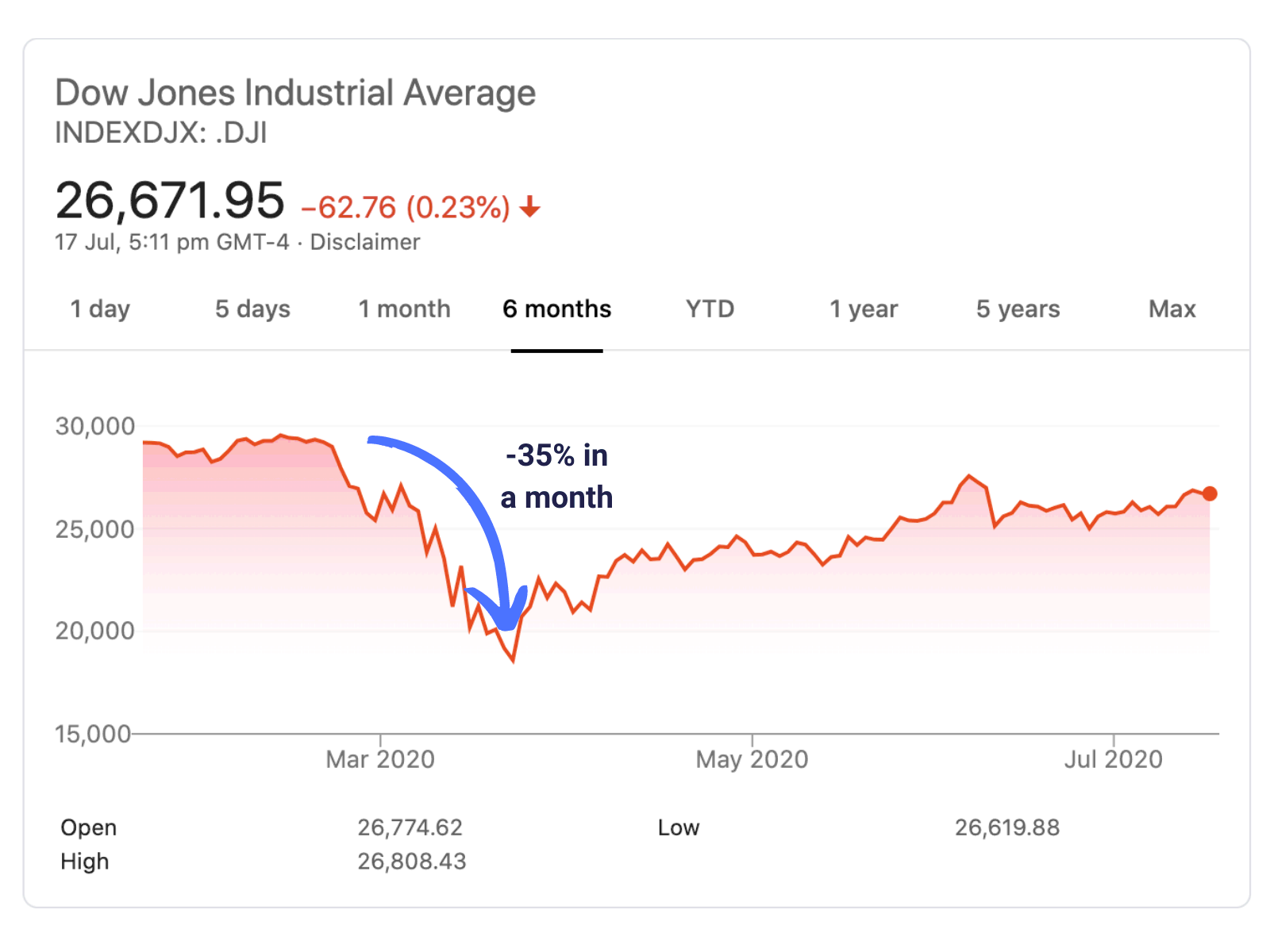

Stay-at-home workers with spare time, government stimulus money and free trading accounts have played a key role in creating today’s Iceberg Illusion. The result is a rapid revival of the Dow Jones Index from a low of 18,000 in March to well over 26,000 today.

Fired up by noisy chatroom pundits like “Davey Day Trader”, these first-time investors have backed an unusual mix of stocks. Their portfolios include mothballed airlines, cruise liners and the bankrupt Hertz rental company.

Such irrational exuberance has been a characteristic of previous stock market bubbles including the 1990s Dotcom Mania and China’s market fever of 2015. However, seldom have stock prices diverged so sharply from economic fundamentals as during the current pandemic.

Investor Dreams vs Cold Market Reality

In less than 6 months, Covid-19 has spread around the world, shutting down most economic activity. US GDP is expected to fall by nearly five per cent in 2020. Likewise, G20 countries face a decline of more than seven per cent.

Staff continue to be furloughed on reduced pay in multiple markets. Besides, many workers may face permanent unemployment following the ending of government salary subsidies.

Infection rates are still rising globally and no vaccine will be available for the foreseeable future. Hence, the restoration of consumer confidence will take considerable time and delay recovery.

The sharp contrast between the real economy and the stock market is sobering. It also demonstrates that the current Iceberg Illusion is inescapable. Ice floating in a frigid ocean creates an invisible threat to passing vessels by hiding nine-tenths of its bulk underwater.

Likewise, a new generation of investors fails to perceive the unforeseen risks in the real economy. The result is a large number of dangerous stock bets in a frothy market.

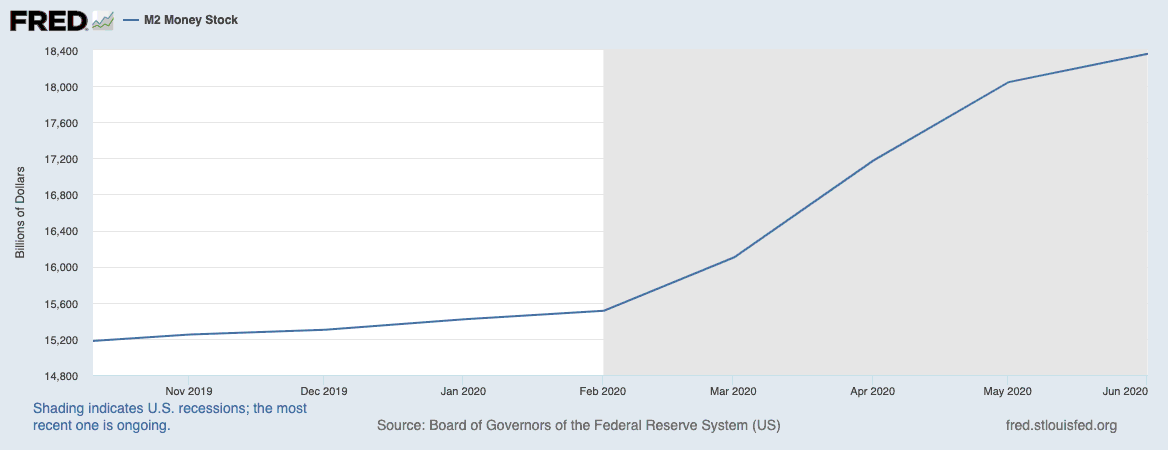

Quantitative Easing (QE) measures are temporarily helping to mitigate this risk. On March 23rd, Federal Reserve Chairman Jerome Powell reduced interest rates to zero. The FED also cut back reserve requirements by US banks. Since then, the FED has injected liquidity in the economy and has printed nearly 3,000 billion dollars. Furthermore, it increased the M2 Money supply by an unprecedented amount.

Monetary Supply Increase Data by the Federal Reserve of US

Unfortunately, the bubbly stock market remains badly mismatched with the complex economic problems created by the pandemic. The emergence of future shocks is likely to create a rapid rise in financial market risk.

Learning to manage financial risks is thus vital to sustain and prepare for such pessimistic market conditions.

Future Risk Factors For Financial Markets

Here are factors likely to create potential market shocks in the coming months:

A rushed reopening will increase the threat level

Open the economy too soon and governments risk a second wave of infection. This scenario represents a significant threat in the US and other markets. It is a considerable concern in countries where the infection rate is not yet under control.

A resurgence can damp down consumer confidence and delay economic recovery. It can also magnify the healthcare crisis. The combination of closure of businesses and job losses could lead to a financial disaster. Ultimately, it could likely create an economic crisis of massive proportions.

The recession has already arrived – and may yet worsen

The US has seen unemployment rise from near zero to about 20 per cent. In fact, the number of job seekers has increased by 40 million. Furthermore, the Government has allocated USD 500 billion to support organisations survive the crisis. However, many small businesses will quickly come under pressure because they have access to lower levels of working capital. Consequently, a high proportion of SMEs will probably go out of business, resulting in even more people out of work.

The battle between economic powers is intensifying

Covid-19 has exacerbated the tension between the US and China, rekindling the trade war conflict. As a result, the pressure is expected to rise in the build-up to November’s presidential election. As China’s power grows, the US becomes increasingly unsettled by its perceived threat. The battle for global influence will inevitably cause further issues. Also, international co-operation between states and institutions will be hampered. Since financial markets abhor uncertainty, this situation will significantly impact efforts to secure global health and economic recovery.

Consumer spending has fallen dramatically

This crisis has already caused a significant drop in consumer activity and a drastic rise in unemployment. It has also reduced international travel and trade to a minimum, not since the great recession of the 1930s has the world economy seen such a massive fall.

The weak retail performance will weigh even more heavily on stock markets. Unless there is a surprising turn around leading into the third quarter, the current recession will likely be extended still further.

Financial markets are effectively uncoupled from the real economy. Without any good news on the horizon, stocks are likely to become the next victim of the Iceberg Illusion.

Consequently, investors need to be extremely cautious about their investments over the next 12-24 months.

How To Protect Your Investment Portfolio

Urgent steps to protect your investment portfolio include:

- Aim for balance in your portfolio – don’t risk everything on stocks

- Minimise and spread your risk across multiple asset types

- Maintain adequate liquidity to address unforeseen future problems

- Consider Alternative Assets including counter-cyclical and recession-resistant opportunities.

Brought to you by Velotrade, a marketplace for corporates to access financing.

When Alternative Assets Go Mainstream

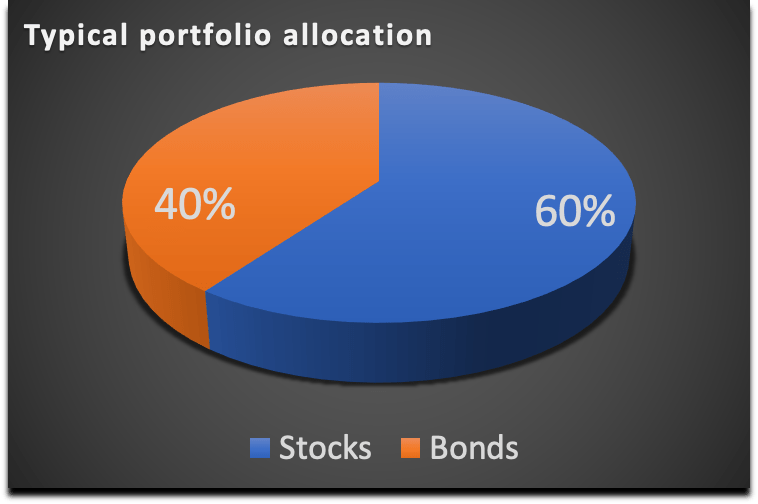

A classic stock-bond portfolio allocation

A traditional investment portfolio is typically split 60-40 between stocks and bonds. This model has proved reliable during periods of economic stability. Today, however, it is under pressure in an era dominated by QE and rising inflation.

Investors are increasingly looking to diversify and reduce risk. In the current uncertain environment, they are also searching for a better rate of return.

As a result, alternative assets are growing in popularity. These range from more traditional assets like Hedge Funds, Private Equity, Venture Capital and Derivatives to more alternative sources of yield such as Infrastructure, Mineral Rights and Real Estate. In addition, some other Alternatives have recently achieved wider appeal such as Cannabis, Art, Antiques and Collectibles.

Outside the mainstream, returns on Alternatives can be significantly higher. Furthermore, those assets add valuable counter-cyclical balance to a portfolio.

Choosing among Alternatives is highly personal and allows more active involvement than traditional investments. It also enables leveraging pastime interests such as wine, classic cars or antiques.

However, investors must be familiar with the particular pitfalls of any Alternative Asset. The investor needs to understand the unique risks involved with those assets, including lower levels of market transparency, liquidity and efficiency. Consequently, due diligence, risk management and regulatory compliance play a particularly important role.

This process often needs to be customised because of the complex nature of each asset. There are hidden risks of Alternative Assets and the expected outcome must be carefully managed.

Given their advantages, it is no surprise that Alternatives are thriving.

Here is a summary of the leading Alternative Assets:

Financial Assets

Private Equity

Private Equity (PE) involves share ownership of companies that are not listed on a public exchange. Those firms raise funds from non-institutional as well as institutional investors. They use that money to buy or invest in a business to later sell for profit.

Depending on the company’s stage of development, Private Equity investments can take on different forms:

- Venture Capital: Funding help promising startup and early-stage ventures. It helps those companies to grow and achieve long-term success.

- Growth Capital: Enables mature companies to build out new product lines or to expand across different geographies. With the funds, the company can also change the organisation structure.

- Buyouts: Capital used to buy another company or one of its divisions.

- Private Equity investments offer significant potential rewards. As a consequence, they show a correspondingly high level of risk should a company fail to perform. The stock market does not influence the valuation of unlisted companies. Hence, there is no immediate risk of losing investment value.

However, PE needs longer-term commitment and more significant sums of money than other sectors. PE may not suit investors who are looking for increased flexibility to avoid the risks of economic fallout relating to Covid-19.

Hedge Funds

Hedge Funds use various strategies to exceed market returns. Their main targets are high-net-worth individuals and institutional investors.

Most Hedge Funds invest in traditional securities such as stocks, bonds and commodities. However, they use a more sophisticated approach than conventional investments. They attempt to profit from rising and falling markets with long and short positions.

The promise of high returns that made Hedge Funds so famous has been eroded in recent years, because of:

- a recent increase in competition

- the rise of passive investment funds

- prohibitively high fees

However, Hedge Funds still retain a useful niche and a value for investors. Hence, some investors are prepared to lock up funds for a significant period. Likewise, they are willing to accept the risks inherent in aggressively leveraged returns.

Private Debt / Invoice Financing

Private Debt includes any debt held by or extended to privately-held companies. A company uses private debt when it lacks funds or assets to support business expansion. Private debt or loans from non-bank institutions are an alternative to bank lending.

One of the most accessible forms of funding for manufacturing businesses is Invoice Financing. It enables SMEs to finance the invoices they issue to overseas clients to access working capital.

Invoice Financing services are priced to match the low margins of manufacturing businesses. Financial institutions profit from the interest payments on the credit provided.

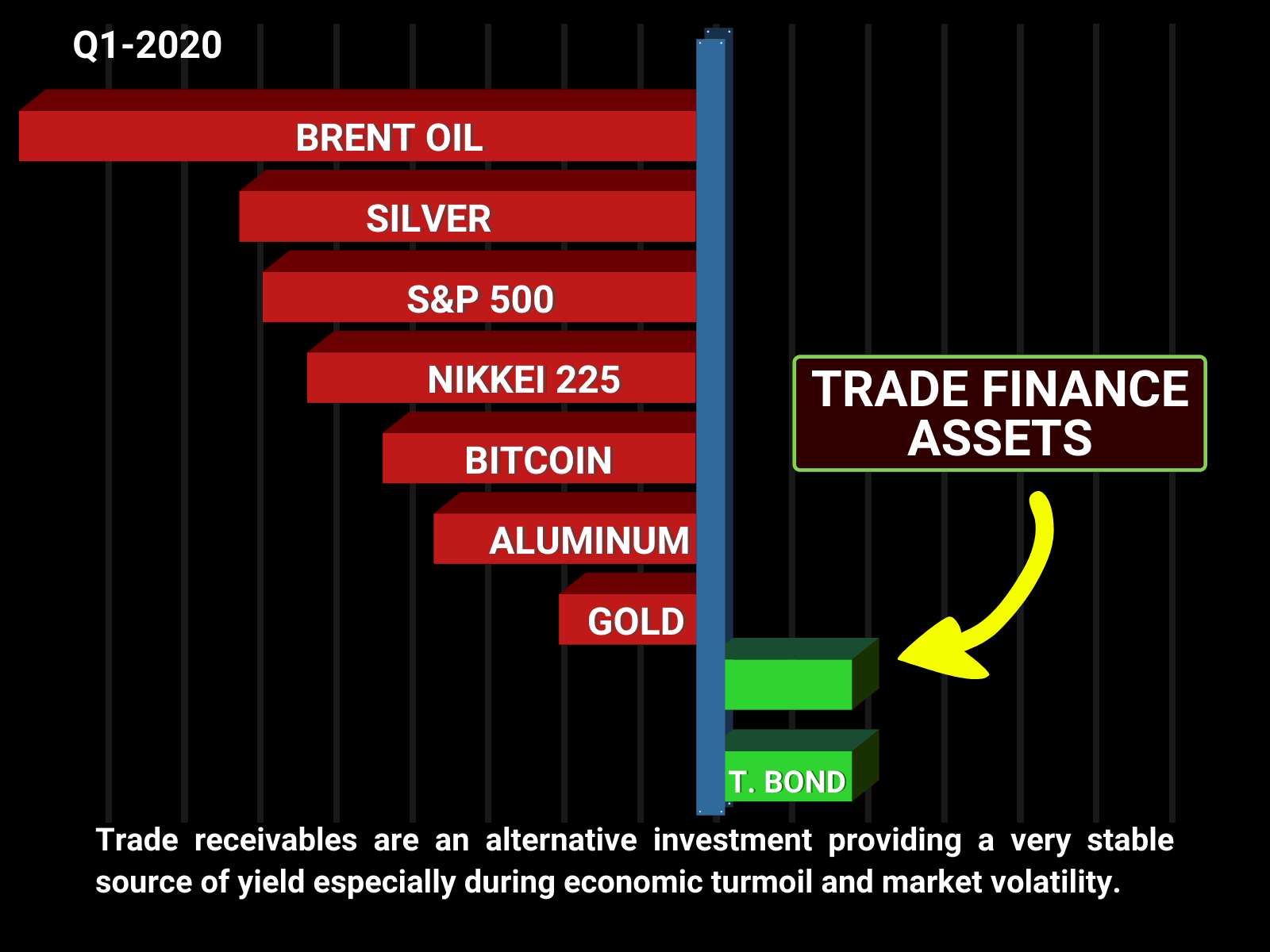

Alternative Assets vs Traditional Assets Q1 2020 Yield Growth

Invoice Financing shows a low correlation with the stock market, offering investors some protection in case of a decline. Furthermore, it provides the opportunity for portfolio diversification into new sectors.

In periods of economic turmoil and market volatility, trade receivables remain a very stable source of yield; they are short dated and are continuously repriced to reflect the increased default risk (if any) of the Debtors. In such situations even if Central Banks were to cut rates, yields in the factoring space will remain high as the demand for liquidity remains high.

Other important benefits of Invoice Financing are:

- A competitive rate of return

- Maintenance of high levels of liquidity due to rapid cash turnover (The lifespan of a typical invoice is 60 days)

Tangible, Real-World Assets

Real Estate

It is an alternative investment featuring office buildings or residential apartments. It is also known as the world’s most significant asset class.

Those assets offers owners the dual benefits of steady cash flow and capital gain. On one side, there is a regular money flow from rental income. On the other hand, capital accumulation increases in value over time.

The asset shows a low correlation with other investments and less volatility than stocks and bonds. However, it remains a highly illiquid asset class. It also requires a substantial financial commitment and is difficult to buy and sell at short notice. Consequently, it falls into the category of a long term investment plan.

An alternative approach to direct investment in property is a Real Estate Investment Trust (REIT). This offers flexibility and annual returns in the form of dividends or profit share.

It is important to note that commercial properties face significant new challenges as a result of the Covid-19 pandemic. The recent trend of working from home is likely to result in the downsizing of company office space.

Meanwhile, the retail property sector faces a growing threat from e-commerce. Recently, consumers have preferred to stay away from shopping malls.

One area with a more positive outlook is Warehousing where demand has been escalating due to the Internet shopping boom.

Collectibles

Collectibles such as Art, Antiques, Vintage Cars and Stamps have seen a boost in popularity in recent years. The combination of appeal and scarcity guarantees an increase in value over time. However, collectibles are not very liquid and realising paper profit depends on finding the right buyer at the right time. This complication minimises their value as a hedge against volatile markets that may need to be unlocked at short notice.

Commodities

The global commodity market is fully developed. It allows investors to consider a wide range of options such as copper, gold, oil, gas, beef and grain. Timing is critical when entering the commodities market: entering at the right stage of the price cycle is essentito realise a profit. Consequently, successful investing in commodities requires expert skills or fortunate timing… or both!

Beating the Iceberg Illusion: The Case For Alternative Assets

Facing the Covid-19 pandemic, economic and financial market risks are higher than ever. This situation is exacerbated by current political and economic uncertainties around the globe. As a result, portfolio diversification is critical. While recession-proofing is hard to achieve, it remains a key goal for the successful investor.

When it comes to looking for suitable assets to strengthen an investment portfolio, Alternative Assets have a pivotal role to play. Investment in trade receivables can help you achieve the stability, yield, and diversification that you are looking for.

Choices can be mixed and matched from the ideas proposed above. At the same time, the importance of ensuring adequate liquidity is a practical approach that should not be overlooked.

Secured

Uncorrelated

Trade receivables offer attractive yields during tough economic times due to their low market correlation.