The set-up of an escrow agreement solves many trust issues between counterparts with limited information about each other.

![]() Highlights of this article:

Highlights of this article:

- What Legal Documents are Required to Use an Escrow Service?

The Sale Contract, NDA, and Escrow agreements - What are the Practical use of an Escrow Account?

An example using EXW – InCoTerms - Would you like to protect your cross-border trading activities?

Maybe an escrow agent is what you need

Content

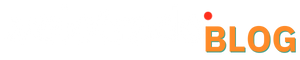

Escrow: Parties Involved

There are 3 parties involved in an escrow account service agreement:

- The buyer (purchasing company or individual)

- The seller (a supplier, factory or a trading company)

- The escrow agent (the escrow service provider)

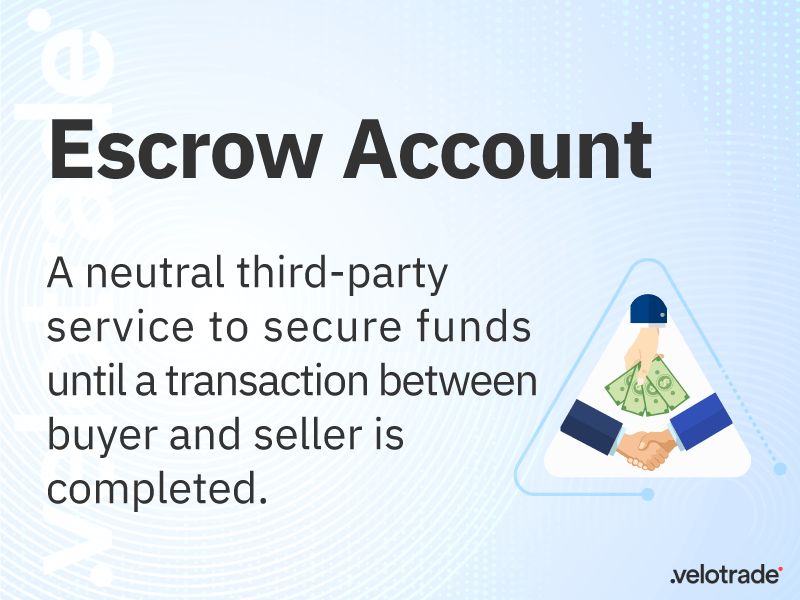

Escrow Account Legal Requirements

The parties involved must sign the following documents to pledge to an escrow service.

Sale Agreement

The buyer agrees to make the purchase within a specific timeline, and the seller agrees to provide the goods (or services) on or by that day.

The sales agreement contains transactional information such as:

- Identification of the parties

- Description of the Service and/or Goods

- Delivery terms: timeline, incoterms and location

- Price, currency and payment terms

- Liability for defected products

Non-Disclosure Agreement

A non-disclosure agreement, also known as a confidentiality agreement, is a legally binding contract in which the parties agree not to divulge proprietary information or trade secrets.

Each counterpart signs a Non-Disclosure Agreement (NDA) to build a confidential and mutual relationship.

Required elements of an NDA include:

- Identification of the participants

- Definition of what is considered confidential

- Duration of the agreement

- Exclusion from confidentiality protection

Escrow Agreement

All the parties involved enter a 3-way legal agreement with the escrow agent.

The escrow agreement contains the instructions, obligations and conditions that must be met for the funds to be released.

Also, this document contains the account details and banking information of all the counterparts involved.

Components of Escrow Agreements:

- Identification of the participants

- Details of the promise to be fulfilled

- Deposit amount in escrow

- Conditions to the release of the escrow funds

- Obligations and liabilities of the escrow agent

- Fees and expenses

- Legal jurisdiction

Practical use of escrow account:

- Real Estate

- Stock market

- Mergers & Acquisitions

- Commercial activities

- Second-hand markets

Escrow accounts highly facilitate the eCommerce financing process for online firms working with third party marketplaces.

How Does The Escrow Account Work?

An example using EXW InCoTerms:

After settling the commercial terms (sale agreement), all the parties agree to use the escrow account provided by Velotrade.

The parties involved are onboarded after the due diligence procedure, Know Your Client – KYC. This standard practice assures customers’ legitimacy and helps identify risk factors, such as:

- anti-money laundering

- embargo & international sanctions

- financial frauds, terrorism financing, and other financial crimes.

Subsequently, all the parties involved in the escrow service must sign a Non-Disclosure Agreement (NDA).

Once the KYC and the NDA are accepted, the buyer, seller and the escrow agent sign the Escrow Agreement.

The buyer transfers the funds into escrow.

The escrow agent informs the seller of funds receipts, and the production process can begin according to the terms in the sale agreement.

The funds are held in trust in a segregated client account at a well-known financial institution (a large commercial bank).

After the goods are produced, the buyer can verify the quality and the conformity of the items to the purchase order (Quality Assurance). If the articles conform with the sale agreement, the buyer will instruct the escrow agent to release the funds.

The funds are transferred to the seller’s bank account.

The forwarder collects the goods, and the buyer gains ownership of the goods, which are then sent to the loading port to clear customs.

Are You Looking For an Escrow Agent?

If you are looking for an escrow account service, Velotrade is the agent that you are looking for!

Our KYC is fast, simple and fully digital.

We do not ask you to fill out endless paper forms and send the documents to our office. We use electronic signature verification.

Hassle-Free

Paper-Free

Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions.