The ongoing GameStop stock trading saga has caused chaos on Wall Street – but it has also positively highlighted how open financial markets are becoming today.

When hedge funds bet against the GameStop share price, they didn’t bargain on day traders leveraging the Reddit chat r/wallstreetbets in a call to arms.

Sensing the opportunity for a quick profit, small investors took up the cause on RobinHood.

Content

As GameStop rapidly rose in value from US$2 billion to US$24 billion in a matter of days, hedge funds found themselves facing a weapon of their own design.

The ‘Squeeze Contagion’ left them with little choice but to pay a high price on their short contracts. Professional investors were upset by the prospect of losing to ‘dumb money’. Much mud-slinging ensued, regulators expressed concerns, but the hedge funds seem to have been forced to accept defeat in this particular battle.

The day traders were fortified by their surprising victory. They have since put money into other heavily shorted stocks.

Price rises have followed in the shares of several under-performing businesses such as cinema chain, AMC, smartphone maker, Blackberry and networking company, Nokia.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Day Traders vs Wall Street

This unusual market activity has been driven by a group of retail investors with a shared sense of purpose to beat Wall Street at its own game while making a profit.

Their voices have been loudly heard on social media investment channels. Thousands of enthusiastic followers access to no-commission trading accounts. The response from finance professionals, regulators and government officials has been one of incredulity.

There is uncertainty about how to address a trend that is forcing share prices beyond realistic valuations. Widespread chatter on social media might be shown to have broken existing rules, but the anonymity of participants may complicate legal enforcement.

Bigger Problems Looming

Investors have been concerned for months about the risk of a growing stockmarket bubble.

Specifically, the continuing rise in tech stock valuations and the extraordinary gains made by new market heroes such as Tesla.

Now, the potential for further unpredictable interventions by retail investors has added another layer of risk to the investment landscape.

If a new round of quarterly reports from leading US stocks reveals less than stellar earnings results, the possibility of greater volatility may loom larger still.

The Investor’s Challenge in Uncertain Times

Investing can be a bruising game.

Even at the best of times, it is exceedingly difficult to time the market in order to sell at the top and buy at the bottom.

Today, low interest rates, the availability of cheap money, represent trends that point to greater market uncertainty. In a time of high stock valuations, unusual price movements can trigger wider contagion. So we can expect more unusual stock movements and a higher risk environment in the future.

Regardless of the volatile market, investors foresee optimism in 2021.

The Rise of Alternative Assets

As the above story illustrates, stocks are not necessarily the best investment tool. Thankfully, several alternative assets are growing in popularity. So, stocks are far from the only choice available.

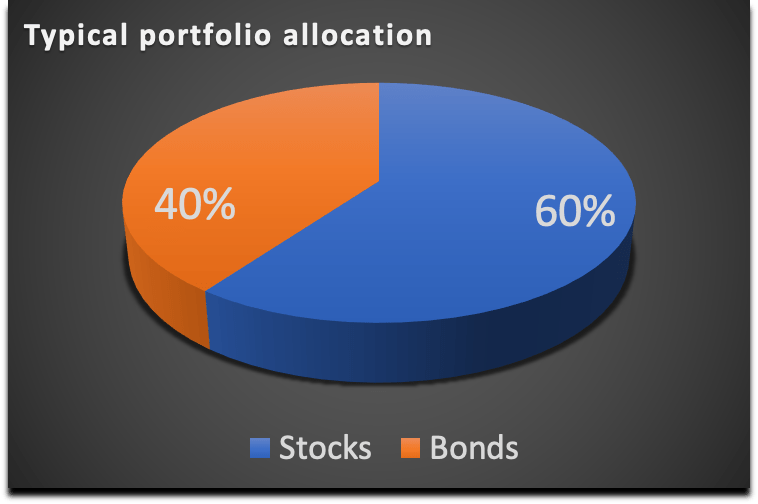

A classic stock-bond portfolio allocation

A traditional investment portfolio is split 60/40 between stocks and bonds.

Today this approach is threatened by the high price of shares. The irrationality of the GameStop saga pushes the pressure on underperforming stocks such as AMC, Blackberry and Nokia.

Add to this the low interest rate environment that is driving bond prices to record highs and it is no surprise that the traditional portfolio investing approach is losing its appeal.

Diversification is the name of the game to boost risk reduction and alternative assets offer many benefits.

Niche assets can provide significantly higher rates of return.

Importantly, they are often uncorrelated with traditionally more favoured investment sectors.

However, they do require in-depth knowledge – so time needs to be invested to bolster understanding.

Fortunately, the rise of Fintech tools is now empowering serious investors to make the right choices and easing the process of stepping into new asset classes.

Can Technology Transform the Situation?

The ease with which day traders were able to place winning bets against big-name hedge funds illustrates the new era of openness in finance.

Ideas are quickly shared through social media investor channels and instantly turned into stock choices on low cost trading platforms.

Of course, finance professionals may see a dangerous trend here, fearful that opportunists are taking extreme measures to disrupt market equilibrium.

However, this phenomenon also underlines how Fintech platforms provide new investment opportunities to regular investors.

Democratised Online Finance

For most of us this fundamental market change creates tremendous business benefits.

Nowhere is this more apparent than in Trade Finance, a market that faces a global shortfall of around USD 1.5 trillion because old fashioned banks fall short in providing the necessary loans to support the working capital requirements of manufacturing small and medium size enterprises (SMEs).

Trade Finance also provides a range of alternative investment choices that are not aligned with stock market risk.

At a time when NYSE, NASDAQ and other markets are fully valued and subject to unexpected shocks as in the case of the GameStop story, alternatives offer a reassuring balance to any investment portfolio.