As the world faces an array of problems due to human’s excessive consumption habits, our society is increasingly shifting towards sustainable growth.

Growing concerns for environmental issues have caused companies to initiate activities that support our ecosystem. It is important that organisations adopt forward-looking ESG practices if they want to remain competitive.

To implement and adapt to this growing trend, one needs to understand the concept of ESG. Read further as this article gives you insights on:

![]() Highlights of this article:

Highlights of this article:

- 3 Components of ESG

To protect the Environment, Social welfare and its Governance structure - How is ESG Calculated?

ESG Score and corporate evaluation - ESG for Corporates and Investors

How Corporates and Investors can benefit from implementing ESG? - 5 ways to Create Value with ESG

Increase growth, reduce costs, lower risk of adverse government intervention, and improve asset and employee productivity - What’s in for You?

ESG seems to be making the world of finance more attractive

Content

Environmental sustainability is a key goal and taking steps to address the day-to-day impact of our business practice is essential for any organisation.

What is ESG?

ESG stands for Environmental, Social and Governance which takes a comprehensive approach to monitoring the impact of a business based on these three factors. This involves meeting relevant regulations, as well as implementing diversity and inclusivity within an organisation.

Environmental – How well does the venture protect the environment?

This takes variables such as climate change, greenhouse emissions, waste, pollution, biodiversity, and the like into consideration. Measuring environmental data encourages a business owner to start thinking of ways to cut energy, water and waste usage which becomes a cost saving exercise.

A strong environmental score indicates that the company is more efficient.

Social – How well does the venture protect people?

This not only includes the safety and equality of employees, but also how actively institutions engage with the community for society’s betterment.

A high social score implies a safe working environment for employees. It also shows their growing initiative in creating a safe, and environmentally friendly planet for the ecosystem.

Such organisations tend to build a more attractive business culture. This in turn helps them maintain a lower staff turnover, and better cost structure.

Governance – How equitably does the venture govern itself?

This aspect of ESG takes issues related to business ethics, corruption, compliance into account.

A high governance score indicates that an organisation is compliant, and ethical in its business and decisions. Good risk management has a strong appeal to investors, customers, and the supply chain.

ESG Score Evaluation

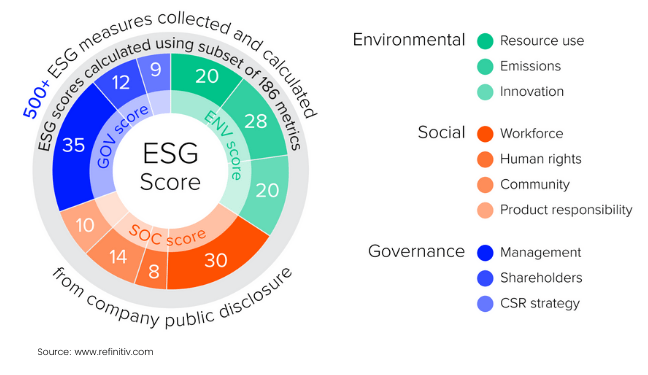

Rating and financial data companies like S&P, Thomson Reuters and Refinitiv, assign a score to the above 3 ESG factors.

Take Refinitiv for example.

It is one of the world’s largest financial data providers. Refinitiv collects and calculates data from over 500 company-level ESG measures. These data points are eventually categorised into 10 categories as can be seen in the chart below.

ESG Score calculation methodology by Refinitiv

A final score is then assigned to each category.

Refinitiv’s ESG score calculation guide provides deeper insights on how the scores are computed. An overall ESG score is then derived based on these individual scores as seen in the figure below.

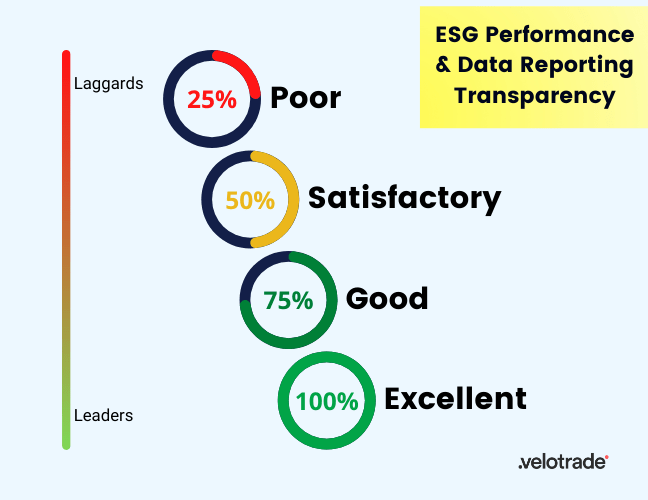

Discrepancies in these scores create comparability issues due to a non-standardised evaluation procedure. The reliability of these scores is therefore subjective.

This approach provides a closer lens by which to analyse and distinguish sustainable business practices from unsustainable ones.

By focusing on all three factors, the result should be a well-balanced portfolio that will perform better than a non-ESG alternative.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

The Two ESG Markets

With the growing significance of ESG emerges two key beneficiaries – Corporates and Investors, who are also target segments of the trade finance market. The high positive impact of ESG on these two markets is increasingly leading them to shift towards ESG alternatives. This in turn holds high relevance for Velotrade.

ESG for Sellers

With society’s value changing due to the rise of sustainability, companies have several opportunities to apply ESG to their daily business practices.

SMEs are also increasingly implementing ESG in their business models. ESG helps ensure the durability of a company’s business model and is a profitable market both in the short and long term.

For businesses with a strong international market or those looking to expand overseas, it is important to recognise that ESG is a significant global issue.

Global supply chains apply huge significance to ESG factors. Big corporations setting standards for their supply chains now ensure that SME suppliers comply with ESG standards that have significant business impact in the short and mid-term.

When companies integrate ESG factors into their business, bank loans, direct investment, equity funding, and trade finance are all activities that become easier to arrange. These companies also instantly become more attractive to investors, which is the other market that drives ESG growth.

ESG for Investors

Investors around the world understand the importance of prioritising ESG factors when looking at new opportunities. They seek ESG as a way of investing sustainably, where investments are made keeping the environment, wellbeing, and the economy in consideration.

It is an important market-based mechanism to help investors better align their portfolios with environmental and social criteria that match sustainable development goals. This is based upon the growing assumption that financial performance is increasingly affected by environmental and social factors.

Recent research finding indicates that a strong ESG proposition correlates with higher equity returns and credit ratings.

ESG investment has grown rapidly over the past decade.

The number of professionally managed portfolios in this field now exceed USD 17.5 trillion globally. Also, the growth of ESG-related investment products available to institutional and retail investors exceed USD 1 trillion. This number continues to grow quickly across major financial markets.

A few years ago, only a minority of investors considered ESG factors. These numbers are expected to grow in the future.

Growing investor interest in sustainable investing reflects the view that Environmental, Social and Governance issues affect the long-term performance of almost all businesses. They should therefore be given appropriate consideration in investment decisions.

How ESG Creates Value

The increasing engagement of ESG is creating value for both companies and investors alike. This trending initiative is profiting businesses through cost reduction and revenue generation while leaving a positive footprint on the society at large. Likewise, investors benefit from greater financial returns by better allocating capital through sustainable investing. A research paper by McKinsey states that ESG links to value creation in five essential ways as follows.

-

Increase in Growth Opportunities

A strong ESG proposition brings ample of profitable opportunities with it.

Equitable businesses gain authority trust, allowing them to tap and expand into new markets. Sustainable products, services, and investment opportunities stir demand attracting more B2B and B2C customers.

McKinsey research shows that 70% of surveyed consumers from multiple industries are willing to pay 5% more for a green product with the same performance standard than a non-green alternative. This calls for higher revenue for sustainable businesses.

-

Reduced Costs

ESG integration is also shown to reduce costs for businesses substantially.

Decreased energy consumption and lower water intake can translate to lower cost. This efficient use of resources further helps reduce operating costs for businesses.

The American multinational corporation – 3M saved $2.2 billion ever since it launched its 3Ps (pollution prevention pays) program. It reimagined its manufacturing process by recycling and reusing waste from production. By doing so, companies can save a lot on packaging and waste disposal costs.

-

Lower Risk of Adverse Government and Legal Interventions

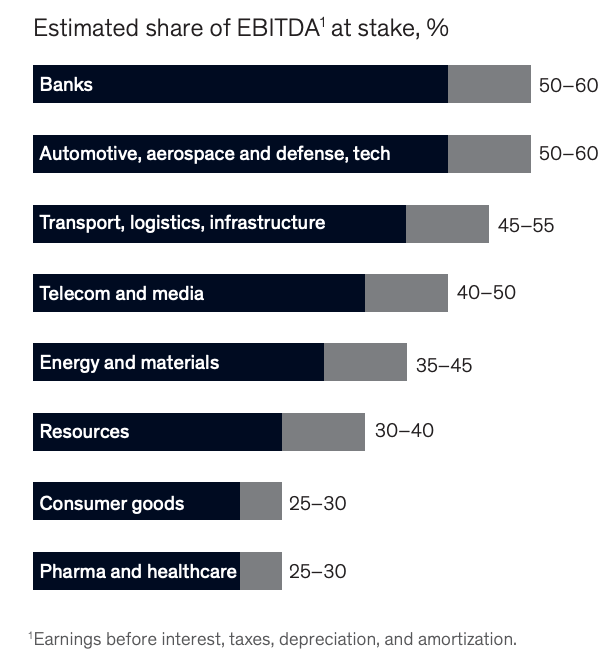

ESG driven companies also receive greater government support and subsidies. Stronger government relationship can enable companies to achieve greater strategic freedom through ease in regulations. The profit at stake through adverse government intervention varies from industries. The chart below represents the profit percentage that is at stake for different industries due to such external engagement.

As seen, banks have the highest percentage of profit value at stake due to the high capital and regulatory requirements. Companies with weak ESG proposition may suffer from advertisement restrictions, penalties, and other adverse actions by the government.

-

Improve Employee Productivity

Companies with strong ESG propositions instil a great sense of purpose among employees.

Employees have high motivation when they know that their work has a meaningful and positive impact on society. As a result, their overall productivity increases.

Employee utility is therefore bound to increase in a more equitable working environment. With high productivity comes high job satisfaction that in turn helps companies attract and retain quality employees.

-

Asset Optimisation and Enhanced Investment Returns

Sustainable ventures also gain enhanced long-term asset returns through impact investment. This includes offering investment in funds of companies that create a measurable positive impact on the environment while offering healthy financial returns.

ESG driven funds are in fact found to generate higher yields than Non-ESG assets. As ESG becomes more universally important, investors are highly incentivised to invest in sustainable assets that generate higher returns. Ventures that do not offer sustainable investment opportunities may therefore lag behind their competitors.

The scope of these impacts vary from sector to sector and business to business. However, the most pivotal factor in the success of an ESG program is the strength of the proposals within it. Weaker propositions may fail to capitalise on the potential economic benefits that come from being ESG friendly.

Why We Should Care?

The trade finance industry has been recognised to achieve the Sustainable Development Goals in the UN Declaration on Financing for Development.

The growing implementation of ESG in finance is surely making the market more attractive.

In the reality of the post-Covid world, ESG will increasingly become central to the economic equation. Trade finance is uniquely placed to mobilise capital at a scale necessary to drive meaningful change.

Velotrade understands that everyone within the trade finance ecosystem needs to incorporate ESG factors into their businesses to build a sustainable future. To cater to this growing market need, Velotrade is taking ESG initiatives by incentivising clients through its Sustainable Trade Financing Program.

The program seeks to benefit sellers from reduced pricing in financing costs. Simultaneously, investors get an opportunity to make a bigger impact through sustainable investing.