Investors are now trying to mitigate risks by investing in sustainable businesses.

This article will unfold the following different facets of ESG investment:

![]() Highlights of this article:

Highlights of this article:

- What is ESG Investing?

Key Drivers and Benefits of ESG Investing - How to Evaluate Corporates ESG Performance

Risks associated with ESG Investing - 4 ESG Investing Strategies

Integrative, Exclusionary, Inclusionary and Impactful

Content

What is ESG Investing?

ESG investing is a form of responsible investing which considers environmental, social, and governance factors of assets within a fund’s portfolio.

ESG investors weigh non-financial factors alongside more traditional metrics when choosing funds. It helps them adjust long-term risks by investing in assets that positively impact society.

Drivers Behind ESG Investing Growth

With a rise in sustainable growth, the adoption of ESG investment practices has been both substantial and exponential.

The ESG investment market is growing and ESG investment is almost inevitable in the modern financial sector.

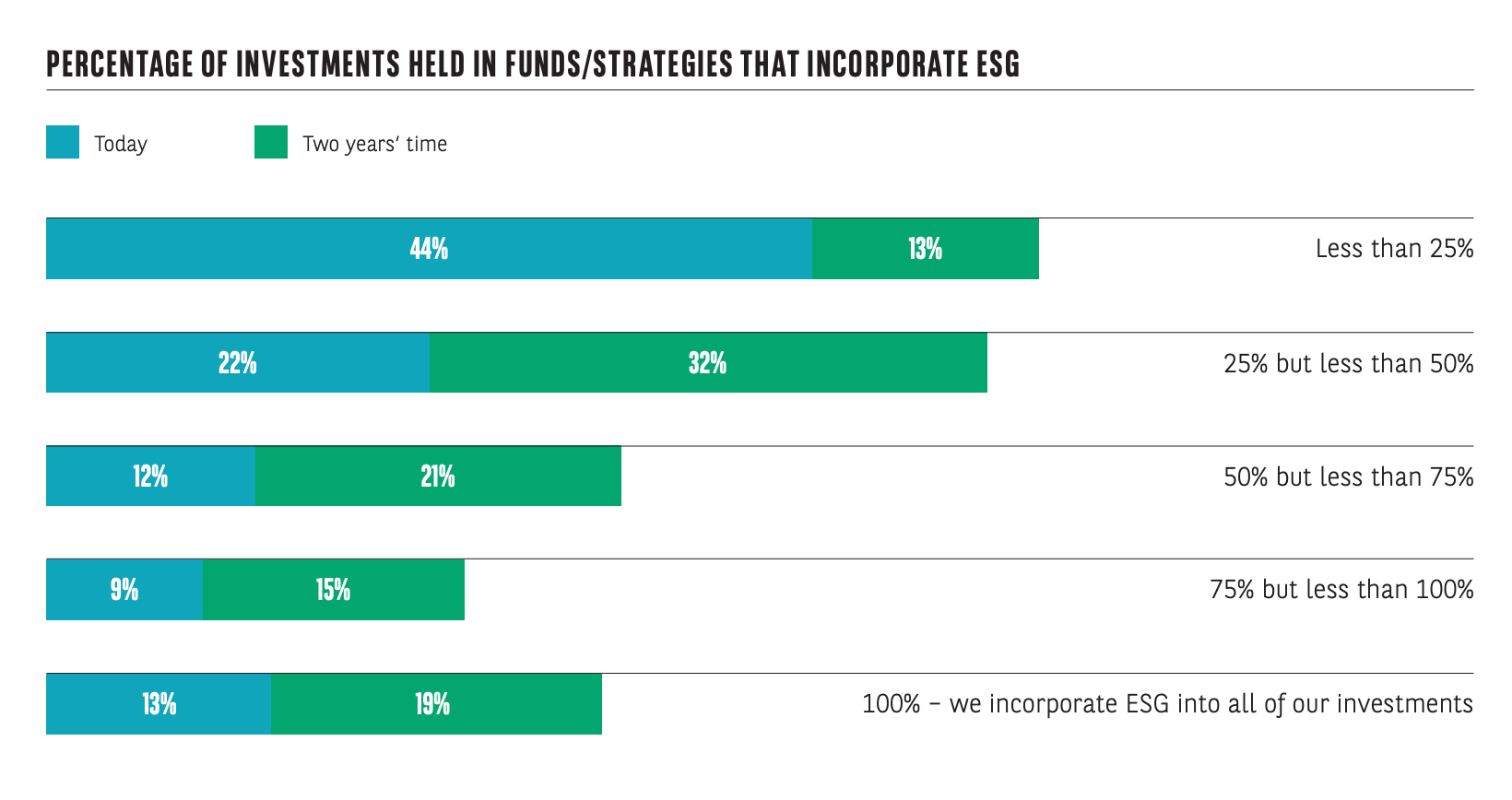

An increasing number of investors are making ESG central to their investment choices. In a 2021 Global ESG Survey, nearly half of the investors said they have less than 25% of liquidity allocated to ESG funds.

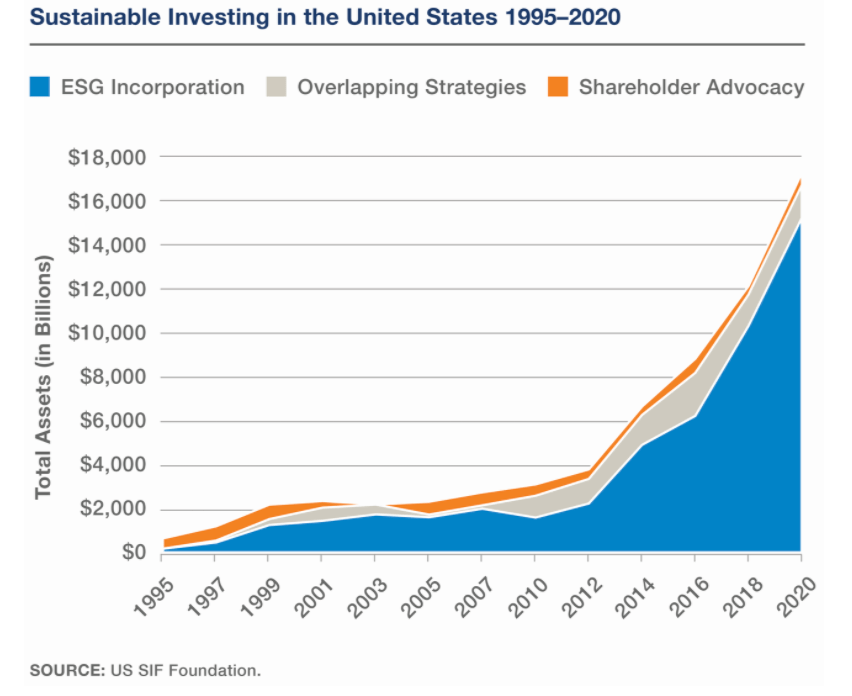

The SIF Foundation’s Report on US ESG investment found that $17.1 trillion of assets under management by 2019 used one or more sustainable investing strategies.

A sharp 42% rise from 2017!

Asia

In a 2019 HSBC report, 86% of Asian investors and 84% of issuers considered ESG factors important.

Being one of the largest financial hubs in the region, Hong Kong accounts for significant growth in this green finance market.

Worth US$12.8 billion, the Hong Kong Government Green Bond Programme is one of the largest government-led green bond issuance programmes in the world. The sustainable finance market is promising in Asia, especially the Hong Kong market.

We can attribute this spike in market interest in ESG to two key factors.

Increase Consumer Demand

A shift towards the growing importance of sustainability is evident. Earlier generations have historically dismissed sustainability.

However, with environmental issues gaining awareness, there is growing consumer sentiment for supporting sustainable enterprises.

Increase Investor Interest

There is mounting evidence that highly rated ESG assets outperform their unsustainable counterparts.

Effective sustainable businesses tend to yield strong long-term returns despite high initial costs.

As a result, investors believe that allocating capital to ESG friendly assets shall offer better financial performance with lower risk.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Why Choose ESG Investing?

Depending on your company’s ESG proposition, the direct benefits of a given ESG strategy will vary. Overall, ESG yields benefits for different parties.

-

Employees

By investing in ESG funds, your workers benefit from fairer labour practices. Also, employees want to work for companies that support causes which align with their ethics and moral principles.

Companies that bring a societal impact in the world motivate employees to perform better.

One way Velotrade meets the social criteria is through its inclusive and diverse working culture.

This has further instilled fairness and motivation within the workplace.

-

Ecosystem and Species

Supporting such sustainable business practices reduces the negative impact on the environment.

This benefits the planet and the life that inhabits it.

-

Company and Stakeholders

ESG-driven companies gain from government support through ease in regulations.

Improved transparency allows for more effective and lower cost governance.

-

Investors

A 2021 survey conducted by Barclays found that 22% of investors prioritise ESG parameters when selecting a hedge fund.

This is double the proportion from 2020.

ESG annualised returns outperformed over three-, five- and ten-year intervals. Although slightly underperforming in the short term, the future of ESG looks bright for investors.

As ESG implementations and research grows, the effectiveness of ESG will also strengthen.

How to Find ESG Funds?

As ESG gains more momentum, it is becoming easier to find ESG funds due to its sheer quantity. However, saturation also presents the problem of effectively differentiating winners and losers.

Below are three easy ways through which you can find ESG funds:

ESG-Savvy Robo Advisors

Robo advisors offer a more hands-off investment approach by inputting parameters such as time frame and risk tolerance. They can be programmed with any parameters, and ESG is increasingly being integrated into the RA decision-making process.

Robo advisors are predicted to grow to a trillion USD by 2024.

ESG Financial Advisors

The most traditional, labour intensive and substantiated method to find and assess ESG funds is using a financial advisor.

While it is the most expensive of the three options, the experience and guidance of a professional can be invaluable.

Financial advisors will generally also provide more comprehensive financial advice and planning.

DYOR – Do Your Own Research

It is not easy to find impartial and substantiated indexes of ESG funds on your own.

You might look at articles published by well-known news outlets, such as the best 2022 ESG funds by Forbes.

To gain deeper insights, you can also refer to comprehensive ESG funds’ performance charts like the one provided by Bloomberg.

Given the lack of uniformity and transparency limitations, finding and comparing ESG funds will be harder without institutional support.

Don’t despair; ESG is still in its formative stages.

How to Evaluate Corporate ESG Performance?

Despite being in its infancy, several methods exist to assess corporate ESG performance.

Once you have found a few ESG funds, it is essential to make comparisons and evaluate them.

ESG Ratings

ESG scores are assigned to companies to evaluate their ESG performance. These ratings are fantastic in theory as they can help assess the strength of an ESG proposition.

However, differences in ratings provided by different analytics firms often lead to inaccurate corporate evaluation.

ESG ratings are not necessarily linked with ESG performance.

It is advisable to look at different ratings to get a more accurate and holistic picture of an asset.

Analyse Corporate Reports

Corporate reporting allows companies to tell their own internal stories to their stakeholders, increasing transparency amongst different parties. As such, it can be used as another tool to build a clearer picture around an ESG proposition.

Third-Party ESG Data Providers

These can be used to ratify and unify internal stories about ESG.

While corporate reporting is useful, a consolidated and impartial approach can be more reliable and comparable.

By considering different perspectives and sources, you can gain a greater perspective on a company’s ESG performance.

Risks to ESG Investing

Like any form of investment, ESG investing has risks attached to it. The risks involved in ESG assets are similar to those involved in traditional investments.

Aside from usual market risks, ESG funds are also exposed to the following risks:

Interest Rate and Inflation Risk

A study conducted by researchers from Mason University found a strong correlation between ESG funds and interest and inflation rate changes. This may be due to the over reliance of ESG funds on the tech sector.

On average, 30% of ESG funds weigh on the tech sector compared to 27% of the S&P 500 Index. Since tech firms anticipate a significant amount of their cash to flow in future, they are more sensitive to market changes like interest rate fluctuations.

High Correlation to Oil Prices

The study also discovered that ESG funds are more sensitive to changes in oil prices than the S&P 500 Index.

Since oil price fluctuations often reflect economic changes, ESG funds are more vulnerable to this change as they heavily rely on cyclical industries like tech and consumer goods.

Incomplete Disclosures

There is often inconsistency between the ESG framework disclosed by companies and its implementation. It is not evident that all firms who commit to ESG abide by it diligently.

The lack of due diligence can be very costly for an investor.

Limited Knowledge on ESG Investment Analysis

This is a considerable risk for an investor who is new to the ESG investment market.

One needs to be aware of all ESG related investment issues before allocating capital to this fund. Proper and active portfolio management is required.

A logical investment strategy of any kind will involve risk diversification. Therefore, it is advisable to avoid concentrating capital in any one asset class or risk level to mitigate potential losses.

ESG Investment Strategies

Your ESG strategy varies depending on the ESG objectives that you set forward for your company.

The ESG market has been classified into four distinct investment strategies to help you match the strategy that fits you.

Which type of ESG investor are you?

-

ESG Integration

In this strategy, ESG factors are assessed in conjunction with traditional metrics to analyse the risk and profit involved.

For example, a fund manager may integrate ESG simply by ensuring portfolio managers have ESG research embedded in their existing investment tools.

-

Exclusionary Investing

This strategy excludes firms that do not meet specific ESG standards imposed by the fund. These parameters are based on sustainability criteria or other investor objectives.

For example, a firm may choose to exclude companies performing above a specified carbon emissions goal.

Investor objectives may exclude companies with poor reputations based on less empirical factors. These can include anything from poor governance structure to unethical labour practices.

-

Inclusionary Investing

It is also known as ‘ESG tilt’ or positive tilt and is the opposite of exclusionary investing.

Rather than excluding poor ESG performers, inclusionary investing actively pursues the best performers. This strategy increases financial returns by investing in the most effective ESG assets.

For example, if a fund invests in the most promising firms within a sustainability centric industry, such as clean energy, this is an inclusionary ESG strategy.

-

Impact Investing

This investment strategy seeks to maximise the positive impact of investment as equally as financial returns.

Capital is allocated to create a positive environmental and social change. While not ignoring profits, this strategy is more rooted in philanthropy.

For example, a fund manager may invest in bonds that finance affordable healthcare or housing over other bonds with a similar return rate.

Several companies are hence now striving to be ESG friendly. Velotrade’s Sustainable Trade Financing Program is enabling it to meet growing investor needs for ESG assets.