Invoice financing is a short-term borrowing method where businesses sell invoices to unlock cash tied in receivables.

The facility eliminates the 30-120 days waiting period for businesses to receive payment from customers. Funds become available quickly, requiring no assets as collateral, and can be reinvested for growth.

Invoice financing is a collective term for other types of invoice-based lending provided in the market.

![]() Highlights of this article:

Highlights of this article:

- Invoice Financing Process

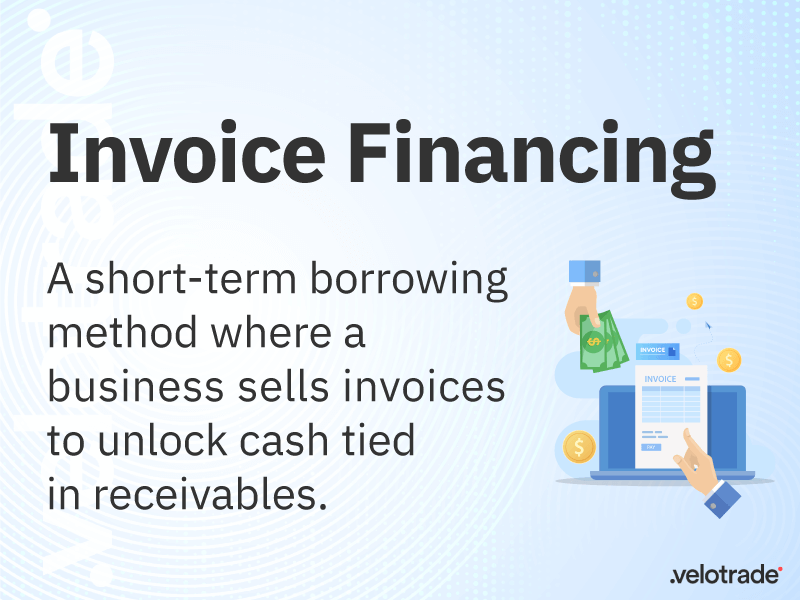

A simplified illustration can help better understand the financing process - Recourse vs non-Recourse Financing

Let’s find out how a business can choose to finance with or without recourse to protect its liability for buyers missing payments - Invoice Financing Practical Example

We use a car manufacturer to show the dynamics behind the calculation - Application Requirements

What are the requirements and how to apply for funding?

Content

Invoice financing, receivables financing and invoice discounting, are terms often used interchangeably as they share many characteristics.

For example, these facilities accelerate a business’s cash flow, allowing them to pay employees, suppliers, and other expenses faster.

How Does Invoice Financing Work?

Invoice financing share the same process flow with other Invoice-based lending facilities, which can be summed up in a few steps:

- A business invoices a client for goods provided, giving them 30-120 days to pay (invoice maturity)

- The business transfers the invoice to a third-party financing company (financier)

- Funds are made available at a percentage (usually ~80%) of the invoice face value

- The customer makes the invoice payment at maturity

- Upon receiving the amount from the buyer, the financier remits the balance back to the business minus fees

However, there is a substantial difference in terms of liability for missing payments (when the buyer doesn’t settle the invoice at maturity).

To protect the business responsibility and liability for buyers missing payments, the business can choose to finance with or without recourse.

Still uncertain on how it works? Watch our invoice financing process video.

What is the Difference Between Recourse and Non-Recourse Financing?

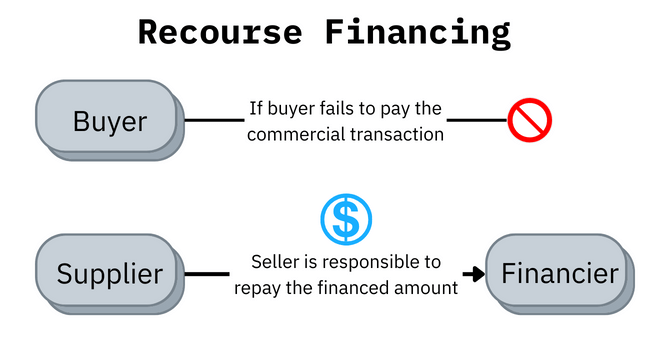

In Recourse Financing, the financier has the right to sell back the invoice to the business if its’ buyer fails to repay. However, with non-recourse financing, the receivables ownership is fully transferred to the financier.

With recourse financing, the business:

- Is liable to pay for any non-payments from the buyer

- Keeps the invoice as an account receivable in its balance sheet

While in non-recourse financing, the invoice is no longer a receivable on the seller’s balance sheet, and the financier is liable to chase buyers for repayments.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Unveil the perks of Invoice Financing with Velotrade and hear what some of our clients have to say!

Invoice Financing Costs

Invoice financing fees depend on several factors, such as:

- invoice value

- days financed

- creditworthiness of the debtor

- the length of the commercial relationship

The table below gives an idea of the costs with different invoice values.

| Invoice $ | 10k | 100k | 500k |

|---|---|---|---|

| Days | 30 | 30 | 30 |

| Service fee | 2% | 2% | 2% |

| Interest rate | 7% | 7% | 7% |

| Advanced $ | 7,800 | 78,000 | 390,000 |

| Maturity $ | 1,954 | 19,540 | 97,699 |

Wondering how the cash advance amount is calculated?

Let’s go through an example.

Car Manufacturer Example

FX Motors sells cars and gives customers 60 days to pay. They recently stroke a deal for $1,000,000, but the company does not want to wait for 60 days to receive the payment from the buyer.

Aware of the invoice financing possibility, FX Motors wonders how much money it can get from the facility.

Usually, the financing company will advance 80% of the invoice amount minus the service fees.

If the service fee is 2%, FX Motors should receive:

1,000,000 ×0.02=20,000

1,000,000 ×0.8=800,000

800,000−20,000=$𝟕𝟖𝟎,𝟎𝟎𝟎

FX Motors receives $780,000 of the $1,000,000 advanced today.

Once the customer pays $1,000,000 back to the financing company, the financing company will transfer the remaining balance minus the interest to FX Motors.

If the interest is 7%, FX Motors should receive:

800,000 ×0.07=56,000

56,000 ×(60/365)=9,205

200,000−9,205=$𝟏𝟗𝟎,𝟕𝟗𝟓

Therefore FX Motors will receive $190,795 out of the remaining invoice balance upon maturity after deducting interest charges.

Invoice Financing with Velotrade

Velotrade’s invoice financing facility is a client-driven solution where data tells us what to enhance.

At Velotrade, we charge only two fees:

- Service Fee – management and administration costs

- Discount Fee – interest charged on the credit amount

According to our latest analysis, here are the reasons why you should be getting your invoice financed with Velotrade:

We cater to several industries and geographies: wholesale trade, manufacturing, retail, transportation and warehousing are a few of the top ones. Data shows we provide financing in 19 locations, with most clients coming from Hong Kong, Vietnam, China, Singapore, and the US.

Business needs:

- We can cover clients with turnovers as large as USD$543,000,000

- Invoice amounts range from a minimum of USD$25,000 to as large as USD$3,124,600

Clients prefer short-term financing

According to Velotrade’s platform data, the average payment term of an invoice financing contract is only 57 days.

Find out how we have helped different industries and businesses globally through two invoice financing client case studies.

Requirements

To apply for invoice financing with Velotrade, a business must meet certain requirements:

You must be a registered company that is:

- in business for 1 year

- with a turnover of over 1 million USD

Your client is:

- in business for at least 3 years

- with a turnover of over 20 million USD

The above requirements are merely guidelines subject to credit assessment as each company is analysed on a case-by-case basis.

Hassle-Free

Paper-Free

Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions.