Invoice factoring is a financing process in which a business sells its unpaid invoices to a financial lender, called a factoring company.

(The applicant) transfers the invoice ownership to the factoring house in exchange for cash, calculated as a percentage of the invoice amount.

![]() Highlights of this article:

Highlights of this article:

- Simple Step-by-Step Guide

Discover how Invoice Factoring Works - Invoice Factoring vs Invoice Discounting, Invoice Factoring vs Receivables Financing

Compare and contrast invoice factoring with other invoice based lending - 3 Advantages of Invoice Factoring

Collateral-free but Expensive Financing - Invoice Factoring Example

Cases where factoring is the ideal financing solution for a business

Content

Invoice factoring allows businesses to access cash flow before clients pay for the goods.

Businesses can reinvest cash to scale, improve the scope, and create opportunities.

How Does Invoice Factoring Work?

The process of invoice factoring is very similar to invoice financing process. However, the two facilities differ when it comes to payment collection and invoice ownership.

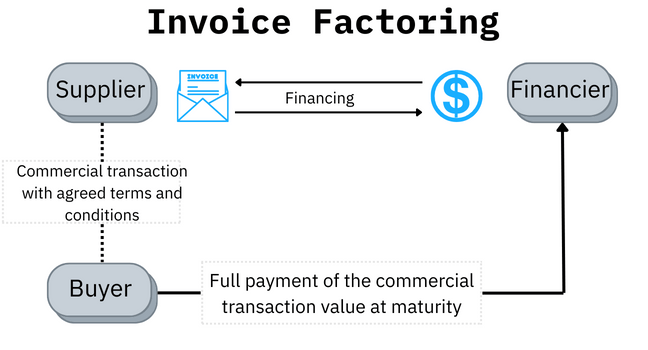

Invoice factoring involves three parties – the business in need of financing (seller), the buyer purchasing the goods (debtor), and the factoring company lending money to the business (the intermediary).

There must be a commercial transaction between the buyer and the seller as a prerequisite.

Invoice factoring step-by-step:

- The seller submits the account receivables (invoice) to the factoring company to determine eligibility.

- The financier calculates the credit limit (based on the risk profile of the counterparts),

- Advances a certain percentage of the invoice, usually 80%

- Become the invoice owner; thus, the invoice is no longer an asset (accounts receivable) on the seller’s balance sheet

- Becomes responsible for payment collection

- The buyer pays the outstanding invoice to the factoring company on the due date.

- The factoring company transfers the remaining balance minus the factoring fees to the seller.

This graph represents a non-recourse factoring process which is the case when the invoice ownership is transferred to the factoring company.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

What happens in the case of Recourse Financing?

Discover the process of Recourse Financing to find the difference!

Invoice Factoring vs Discounting

| Invoice Discounting | Invoice Factoring | |

| Repayment | From Buyer to Lender | From Buyer to Lender |

| Payment Collection | Seller is liable unless non-recourse | Lender is liable unless with recourse |

| Ownership | Remains with seller unless sold to financier | Transferred to lender |

| Confidentiality | Choice to disclose about the financier involvement to debtor | Lender is disclosed to buyer as ownership transfers |

| Flexibility | More Flexible Seller has control on credit and business finances Can finance the invoice of their choice | Less Flexible Lack of credit control Can finance specific invoices only |

Invoice factoring and discounting vary in the flexibility and confidentiality offered to the borrower, but the main difference is the invoice and sales ledger ownership.

In factoring, the seller transfers the invoice and debt collection duties to the intermediary; instead, invoice discounting gives the seller an option.

However, invoice discounting makes the seller liable for payment collection unless the invoice is sold to the lender.

In both cases, the buyer repays the financed amount to the lender.

In conclusion, although invoice discounting offers more flexibility and confidentiality than factoring, the facility is also cheaper. For these reasons, businesses often choose to do discounting over factoring.

Curious to know more?

Discover businesses suitable for invoice discounting with our extensive invoice discounting guide.

Invoice Factoring vs Receivables Financing

Receivables financing is synonymous with invoice discounting because account receivables (mainly invoices) support the transactions. We discussed the differences between factoring and discounting above.

However, unlike factoring, the business can choose the receivables they want to finance.

Understand the suitability and benefits of receivables financing before opting for a financing solution.

Advantages of Invoice Factoring

Hassle-Free Debt Collection

One of the inefficiencies that any small business owner has fallen into at least once is debt collection (payment collection).

Late payments are a big reason why businesses often face cash flow problems.

While large corporates can afford to hire an in-house team for credit control, small business owners don’t have the resources to do so.

Invoice factoring unburdens businesses with this time-consuming task because the factoring company is fully liable to collect buyer payments.

This procedure allows business owners to run their businesses more efficiently and capitalise on building more robust and longer customer relationships.

Debt-free Financing

Factoring does not create additional debt.

Since the ownership is transferred to the factoring company, the invoice becomes an off-balance sheet item and is no longer a liability (debt) for the business.

For this reason, invoice factoring is also known as debt factoring, where businesses get rid of debts like unpaid invoices from their balance sheet.

Easier and Faster Approval

Factoring companies are more interested in your buyer’s creditworthiness than your credit score. They do look at your credit score but not as critically as banks.

The terms are determined based on your business’s account receivables, how much they owe you and how likely they are to pay you.

For this reason, the approval process is usually faster and more hassle-free.

Check out the buyer and seller requirements for invoice financing before applying.

Is Invoice Factoring For Your Business?

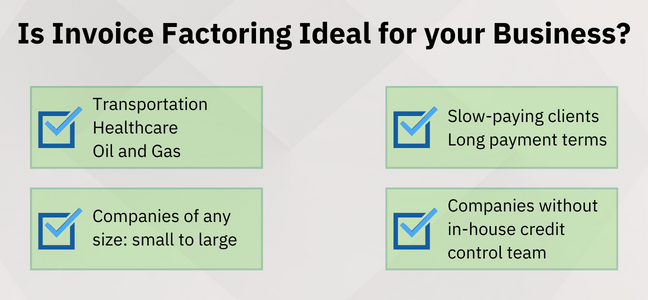

While the benefits highlighted above apply to most businesses, the index below represents the type of companies where the impact is more salient.

Suitable companies

- Due to their lengthy payment nature, transportation, oil & gas, and healthcare businesses are suitable for invoice factoring.

Banks often neglect these industries due to their high risk (think about the volatile commodity market).

Factoring can help improve these businesses’ cash flow by financing their slow-paying clients.

The freight service is an excellent example of this. It is common for companies to have slow-paying freight bills with payment terms of 60 days or more.

Such companies do not mind paying an additional fee to free up cash from these clients’ debts.

- Medium-large companies may not want to invest resources in building an in-house credit control team; as a result, they don’t mind paying the additional cost of outsourcing their debt collection process.

Factoring their invoices can help them get the financial support needed during their growth or distressful phases.

- Meanwhile, larger companies with greater overhead costs that need to speed up their cash flow can opt for factoring. This can include paying for more staff, equipment, utility bills, or legal fees.

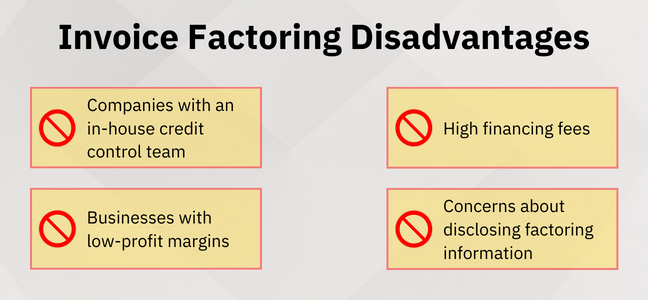

Unsuitable Businesses

While most businesses deem fit for invoice factoring, there are some instances where it may not be an ideal solution:

Businesses that don’t wish to disclose the presence of a factoring company in the process to the buyer as they worry this could hamper commercial relationships.

Businesses that don’t want to lose control of their debt collection process because they already have an established credit-control team. (Factoring transfers the invoice ownership to the financier).

Businesses with low-profit margins. Since the factoring company is liable for payment collection, the fees are often higher than other invoice financing alternatives.

SMEs with insufficient capital who cannot afford to run an in-house credit control team would surely not prefer to pay the higher factoring fees.

An Invoice Factoring Example – Business Case

An Indian grain manufacturer provides kernels to various industries and companies.

The company has grown significantly due to their final product customisation based on each client’s needs.

However, the problem began when their list of supplier payables grew faster than the payment received from their customers.

Their buyers hold good credit standing but pay slowly. These two characteristics make invoice factoring a solution to their aggravating cash flow problems.

The company factored all their outstanding receivables and received immediate cash for the invoice dues.

Invoice factoring helped them settle supplier bills and removed the hassle of chasing late payers while maintaining a comfortable profit margin.

Although the solution was costlier than other alternatives, the company was willing to bear this extra cost to avoid chasing slow-paying customers that hindered its growth.

But what if you are tight on budget and still looking for a cash advance to speed up your cash flow?

Invoice discounting might be the solution for you!

Learn how invoice discounting offers more flexibility to uncover the solution that best fits your needs.