Invoice discounting is a process in which a business sells an invoice to a financing company to access cash tied in unpaid invoices.

Discounting invoices allows businesses to get future cash flow discounted at today’s value.

This is a type of invoice financing solution offered by financial intermediaries based on the invoice issued to the buyer.

![]() Highlights of this article:

Highlights of this article:

- Important Benefits of Invoice Discounting

The invoice ownership could be transferred to the financier as collateral asset, and the invoice will no longer be in the seller’s balance sheet. - Suitable and Unsuitable Scenarios

Invoice discounting is the number one financing option when goods are sold on credit, or if the business is affected by seasonality cash flow fluctuations - Successful Case

Invoice discounting during remote working conditions

Content

Advantages of Invoice Discounting

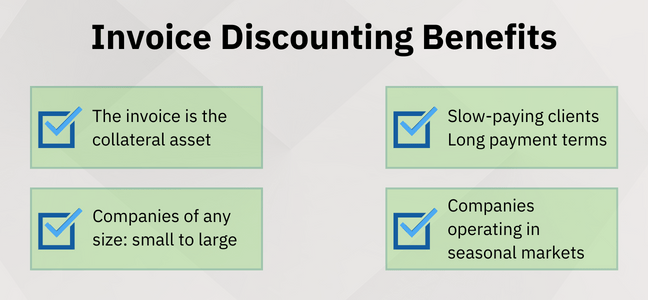

The most important feature of invoice discounting is to help businesses get quick access to cash using the invoice as a collateral asset.

Flexibility of Ownership

The seller has a choice to transfer invoice ownership to the financier.

Since invoices are receivables owed by customers, invoice discounting is also known as receivables financing.

Upon transfer of ownership, the financier is fully liable for collecting payments, and the invoice is no longer an account receivable on the seller’s balance sheet.

However, this procedure fully discloses the business’s sales ledger activities to the financier.

As many firms consider this a lack of credit management, they can opt for financing without losing ownership and control of their credit.

The arrangements are recourse and non-recourse financing. Delve into the recourse and non-recourse financing models to better understand the difference!

Choice of Confidentiality

Many financiers offer sellers the choice to opt for disclosed or undisclosed invoice discounting.

What is the difference?

While the buyer is aware of the financier’s involvement in disclosed invoice discounting, the buyer wouldn’t know when the invoice discounting is undisclosed.

Needless to say, the service fees increase with the level of confidentiality offered.

Invoice Discounting is a type of Asset-Based lending backed by invoices.

Learn the difference between asset finance and asset-based lending to understand better.

Is Invoice Discounting for your Business?

In finance, discounting means converting a value received in a future period to an equivalent value but received immediately without waiting.

For this reason, invoice discounting is often used when goods are sold on credit.

Invoice discounting is ideal for most businesses facing cash flow problems as it helps to generate sales and increase ROI while having the liquidity to optimise the business operations.

Suitable Cases

Generally speaking, most financiers prefer 60 days payment terms. However, businesses with longer payment terms are often accepted if buyers hold good credit standing.

As manufacturing, logistics, and construction companies usually sell on 30-120 days of credit terms, global exporters may not want to wait to receive payments from the buyers. This is because these buyers also have sellers from whom they purchase on credit. These are account payables for businesses in their balance sheet.

Confused? Discern the difference between receivables and payables to gain a better conceptual understanding.

Seasonal businesses with regular cash flow shortfalls during certain times of the year may opt for an invoice discounting facility (think about a company selling winter sports equipment)

Some companies may want to control the sales and credit collection ledger completely. However, these corporates must be large enough to sustain the in-house credit control team, as the associated maintenance costs could be high.

Financing through an invoice financing platform is even better as the entire process is digitised. They usually charge no admin fees, which gives them a competitive edge.

Unsuitable Cases

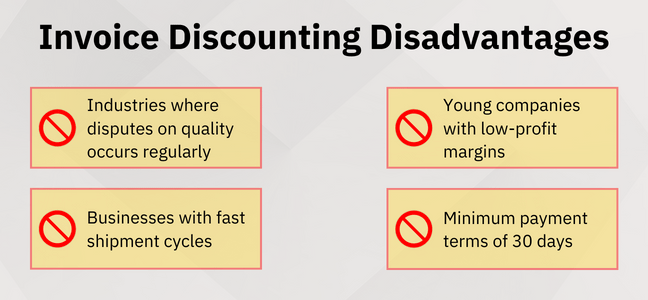

Invoice discounting requires a minimum payment term of 30 days for customers to pay, which may not be ideal for business models with a shorter payment cycle. The paperwork, time, and cost required to open the facility by some financiers may exceed the return on investment (30 days yield)

For example, food chains or eCommerce that incorporate the just-in-time delivery schedule may not be suitable for invoice discounting: their faster shipment cycles and shorter payment terms, such as 14 or 7 days, are not ideal for financiers.

Invoice discounting may not be best for businesses operating with perishable items (food, commodities) or FMCG companies. The reason is simple: too many disputes about poor quality items could be used as a justification not to pay the invoice.

Lastly, young companies with low-profit margins and turnovers are also unsuitable as they do not fit the minimum requirements.

They probably do not have adequate past transaction history to prove their credit management capabilities. Such companies may not be able to afford a discounting invoice facility.

![]() Key Takeaways

Key Takeaways

- Invoice Discounting Helps Bridge Payment Gaps

The facility helps businesses with 30-120 waiting days to meet cash flow immediate requirements - A Flexible Financing Solution

Invoice discounting gives businesses the choice to transfer the responsibility of payment collection to the financier. - Better Trading Conditions

With financing in place, buyers and suppliers can negotiate better terms under strengthened financial health and reduced default risks.

An Invoice Discounting Business Case

The pandemic of 2020 has increased mobile phone and accessories demand in France (and many other countries, in fact).

This Hong Kong wholesaler wanted to grab the opportunity and ramp up its capabilities. With restrictions on human movements across countries, the French owner realised how important it is to opt for an invoice discounting solution with a virtual financier.

The financier’s fully digital system made invoice financing possible, unlike the traditional banking system where the owner is required to attend in person…. welcome to 2023!

With no printed documents required and prompt responses to queries, the client got the entire process done remotely at his convenience.

Getting access to a digital financier was a game-changer for this client.

Curious about the fee?

Know the math behind invoice financing cost calculations through a business case example to understand thoroughly.

Do you want to be one of them? Learn about the invoice financing requirements before applying.

Hassle-Free

Paper-Free

Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions.