The International Chamber of Commerce (ICC) introduced the new rules in effect from 1 January 2020.

A careful study of INCOTERMS 2020 will repay the effort by enabling more favourable trade terms for effective trade finance.

![]() Highlights of this article:

Highlights of this article:

- Changes in Incoterms 2020

Impact of amendments in delivery terms on your business - 7 Incoterms for All Types of Transport

EXW, FCA, CPT, CIP, DPU, DAP, DDP - 4 Incoterms for Sea and Inland Waterway Transports

FAS, FOB, CFR, CIF

Content

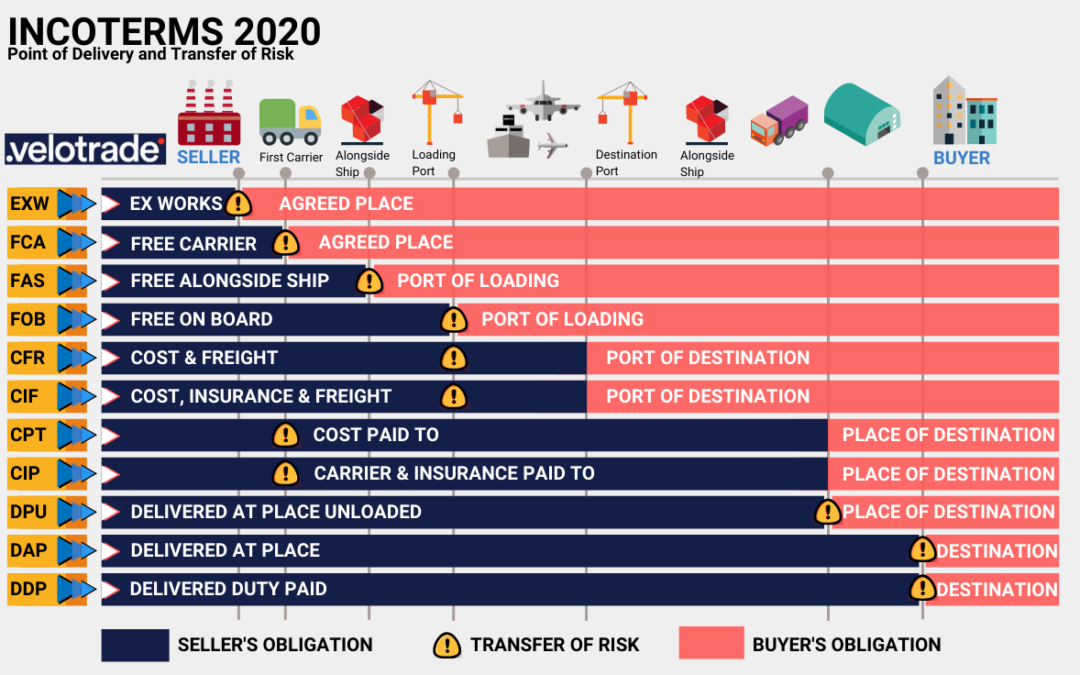

It consists of eleven separate Incoterms with some specific revisions that are worth addressing.

What are the Most Important Changes in InCoTerms 2020?

Incoterms 2020 formally defines the delivery point in the transaction where ‘the risk of loss or damage to the goods passes from the seller to the buyer’. In contrast, previously, the term had a more informal explanation.

Knowing the point of risk transfer eases the transaction for different trade finance parties.

Incoterms 2020 rules make security more prevalent by listing import and export requirements. Also, they help in distinguishing whether the buyer or seller is responsible for meeting each of those requirements.

The updated definitions split the incoterms into 2 groups, each relevant to a specific mode of transport.

The most significant change relates to the term FCA (Free Carrier). It now allows the buyer to instruct the carrier to issue a Bill of Lading with an onboard notation to the seller. By doing so, it satisfies the terms and conditions of a Letter of Credit.

Previously, many exporters preferred to use FOB (Free on Board) to arrange payment under a Letter of Credit. Nonetheless, FCA was more suitable for the shipment of containerised goods. It was due to the extra delivery cost differential between FCA and FOB.

Another major change is the replacement of DAT (Delivered at Terminal) with DPU (Delivered at Place Unloaded). Previously, the word ‘Terminal’ was confusing, and DPU broadly covers all delivery options.

The term CIP (Carriage and Insurance Paid) changes the insurance coverage requirements. The seller, under Institute Cargo Clause A, must purchase a higher level of insurance. The insurance could amount to 110 per cent of the invoice value, which is more appropriate for manufactured goods.

The CIF (Cost Insurance & Freight) is for commodity shipments. The Institute Cargo Clause C specifies the insurance requirements (unchanged).

Additionally, FCA (Free Carrier), DAP (Delivered at Place), DPU (Delivered at Place Unloaded) and DDP (Delivered Duty Paid) now take account of buyers and sellers arranging their own transport rather than using a third party.

Expense allocation between buyer and seller are now listed more precisely to help avoid confusion. In the 2010 Incoterms, costs sometimes became a big issue. Carriers could change their pricing structure by adding back charges. As a consequence, sellers faced additional terminal handling expenses.

Unravel the different InCoTerms costs involved when selecting trade terms for your shipment.

![]() Key Takeaways

Key Takeaways

- What are InCoTerms?

Incoterms are rules for buyers and sellers to follow when formulating a contract for the shipment of goods. - What are InCoTerms 2020?

The terms are divided into 2 groups, each of them based on a mode of transport with the risk transfer point now stated formally. - The most obvious changes?

The most significant changes relates to the term FCA (Free Carrier) and the replacement of DAT (Delivered at Terminal) with DPU (Delivered at Place).

InCoTerms for Any Mode of Transport

Some Incoterms are better suited to specific modes of transport than others. However, below are the ones applicable for any transport mode.

EXW – Ex Works

Under the EXW term, the seller is responsible for making the goods available at its premises. The parties can also agree on another named place such as factory, office or warehouse. At this point, the buyer gains ownership of the goods. Then, he handles all costs and risk after the products are collected.

EXW is most favourable to the seller. He has no obligation to load the goods or to cover freight costs once the goods have left the premises. This term can cause complications for the buyer if products are for export.

FCA – Free Carrier

With FCA, the seller is responsible for delivering the goods to the buyer’s nominated premises. He needs to load the stocks onto the buyer’s transportation. Then, the seller organises the shipping, including export clearance and meeting security requirements.

The risk is transferred once the goods are loaded onto the buyer’s transportation. Thus, any damage to the products when on board the vessel is the responsibility of the buyer.

The buyer pays the cost of freight, bill of lading fees and insurance. Also, he pays for unloading and transportation costs to the final destination.

FCA is the term that has been most significantly changed under the Incoterms 2020 rules. Previously, the use of a transport intermediary meant the seller was unable to obtain a bill of lading with onboard notation. The reason was that he did not present the goods directly to the international shipper. Without the BL, the transacting bank would not authorise payment to the seller.

Under the new Incoterms 2020, FCA resolves this problem. The buyer should instruct the carrier to issue a bill of lading with the onboard notation to the seller. The parties specify this notation on the sale contract.

CPT – Carriage Paid To

CPT goes beyond FCA by specifying that the seller bears the costs of transportation to the buyer’s place of destination. The seller clears the goods for export and delivers them to the carrier or place of destination as instructed by the buyer.

At the defined place of shipment is where the risk is transferred to the buyer. The seller is responsible for the transportation costs associated with delivering goods. However, he is not responsible for procuring insurance.

If the buyer requires the seller to obtain insurance, the parties should consider the Incoterm CIP instead.

CIP – Carriage and Insurance Paid To

CIP is broadly similar to CPT. However, the seller is required to insure the goods in transit and to pay the transportation itself.

The seller clears the goods for export and delivers them to the carrier or place of destination as instructed by the buyer. The seller is responsible for the transportation costs of the items to the designated place of destination.

The risk is transferred to the buyer at the defined place of shipment.

In one of the most significant changes under Incoterms 2020, CIP requires the seller to purchase a higher level of insurance. This level of coverage is appropriate for containerised goods: 110% of the contract value under Institute Cargo Clauses (A) of the Institute of London Underwriters. Previously the minimum insurance was applicable under Institute Cargo Clauses (C).

DPU – Delivered at Place Unloaded

It was previously known as Delivered at Terminal (DAT). It has been renamed because the buyer (or seller) may want to specify the delivery location rather than the terminal. This term is often used for consolidated containers with multiple consignees. It is the only term that tasks the seller with unloading the goods.

The seller covers all the costs of transportation (export fees and carriage). Also, at the destination port, the seller pays the unloading from the carrier and the port charges. He assumes all risks until arrival at the destination port or terminal.

The buyer is responsible for all costs and risks after unloading. It includes import duties, taxes and customs clearance. Also, the buyer pays local transportation to the final named place of destination.

If the seller is not able to organise unloading, he should consider shipping under DAP terms instead.

DAP – Delivered At Place

The seller delivers the goods to a named place of destination but is not responsible for unloading. His responsibilities include packing, export clearance, carriage expenses and any terminal costs up to the agreed destination port.

DAP means the buyer is responsible for all costs, duties and taxes associated with unloading the goods. He is also responsible for clearing customs to import the products into the named country of destination.

The risk is transferred to the buyer at the final designated place of destination.

DDP – Delivered Duty Paid

DDP means the seller bears all risks and costs associated with clearing and delivering the goods to the designated place.

The seller is liable for clearing the goods through customs in the buyer’s country. It includes payment of both duties and taxes. Furthermore, he needs to obtain the necessary authorisations and registrations from the authorities. However, the seller is not responsible for unloading.

This term places the maximum obligations on the seller and minimum obligations on the buyer. The buyer bears no risk or responsibility until the goods are at the final agreed place.

Hence, the term is favourable for online businesses seeking eCommerce financing for cross-border trading.

Unless the seller has a profound understanding of the rules and regulations in the buyer’s country, DDP terms can be a considerable risk both in terms of delays and in unforeseen extra costs. Hence, DDP should be used with caution.

Lacking the funds to fulfil more trades?

Finance your imports and exports to expand your trading capacities.

What Rules Apply for Sea and Inland Waterway Transport?

The following four rules apply to goods shipped by sea or inland waterways.

Usually, the risk and responsibility are transferred when the goods are on board (apart from FAS). As the condition of the items must be verified at this point, these terms are only suitable for non-containerised goods, such as commodities.

Note: in previous editions of Incoterms, the risk passed between the seller and the buyer at the point where the goods crossed the ship’s rail.

FAS – Free Alongside Ship

The seller delivers the goods alongside the buyer’s vessel at the named port of shipment. It means that the buyer bears all costs and risks of loss or damage from that moment.

The FAS term requires the seller to clear the goods for export (under previous Incoterms, the buyer arranged export clearance).

FOB – Free On Board

Under FOB terms, the seller bears costs and risks until the goods are loaded on board of the designated vessel.

The seller’s responsibility includes arranging export clearance. At the same time, the buyer pays the cost of marine freight, bill of lading fees and insurance. He is also responsible for unloading and local transportation costs from the port of arrival to the final destination.

Any damage to the goods when on board the vessel is the responsibility of the buyer.

For this reason, FOB is ideal for invoice financing solutions. This is because the risk of goods is transferred to the buyer once the goods are shipped.

Since Incoterm FCA was introduced in 1980, FOB should be used only for non-containerised sea freight and inland waterway transport.

However, FOB continues to be the most commonly – and incorrectly – term used for all modes of transportation. Despite the contractual risk that can result (which include the difficulty of checking goods if they are enclosed in a container).

CFR – Cost and Freight

CFR incurs more significant risk and responsibility for the seller who pays for the carriage of the goods up to the named port of destination.

The risk is transferred to the buyer at the country of export. Specifically, when the goods have been loaded on board the ship.

The shipper pays for export clearance and freight costs to the selected port. Furthermore, he is responsible for any damage to the goods on board the ship until the port of final destination.

The buyer pays for local delivery from the port to the final destination and is responsible for purchasing insurance. If the buyer requires the seller to obtain insurance, the parties should consider the Incoterm CIF instead.

CFR should only be used for non-containerised sea freight and inland waterway transport. For all other modes of transportation – and for containerised goods – it should be replaced with CPT, as specified in a critical change in Incoterms 2020.

CIF – Cost, Insurance & Freight

The seller clears the goods for export and delivers them when they are on board at the port of shipment. The seller bears the cost of freight and insurance to the designated port of destination. Also, he is responsible for any damage to the goods on board the ship.

The seller needs to purchase the minimum level of insurance under Clause C of the Institute Cargo Clauses. (This requirement is unchanged from Incoterms 2010.)

At the port of arrival, the seller must turn over three key documents – invoice, insurance policy and bill of lading. Those documents represent the cost, insurance and freight of CIF.

This Incoterm is similar to CFR. However, the seller needs to obtain insurance while the goods are in transit.

For a more complete list of the responsibilities for each of the terms, a copy of ICC’s INCOTERMS (R) 2020 book is available here.

Note: While incoterms help to reduce the risks involved in the delivery of goods between seller and buyer, they only form part of the whole export contract. Price, method of payment, transfer of ownership, breach of contract and product liability are all issues that need to be addressed in the contract of sale. Also, Incoterms cannot override any mandatory laws.

Customised

Diverse

Global

Velotrade's dynamic Supply Chain Finance solution fulfills corporate's large trade volumes financing imports and exports from multiple suppliers.