Trade finance and Incoterms are highly related in many aspects. A universally recognised set of rules, Incoterms guide buyers and sellers in creating and fulfilling a contract for the shipment of goods.

Hence, Incoterms is one of the many variables considered when assessing a trade finance application. Companies involved in international trade must have a thorough understanding of Incoterms.

![]() Highlights of this article:

Highlights of this article:

- Incoterms and Trade Finance Defined

Find out which Incoterms are best suited for different trade activities - Costs Associated with Different Incoterms

Know the list of shipping documents required for customs clearance - Incoterms Facilitates Trade Finance

Determine the point of risk transfer in the trading process

Content

Understanding Incoterms and Trade Finance

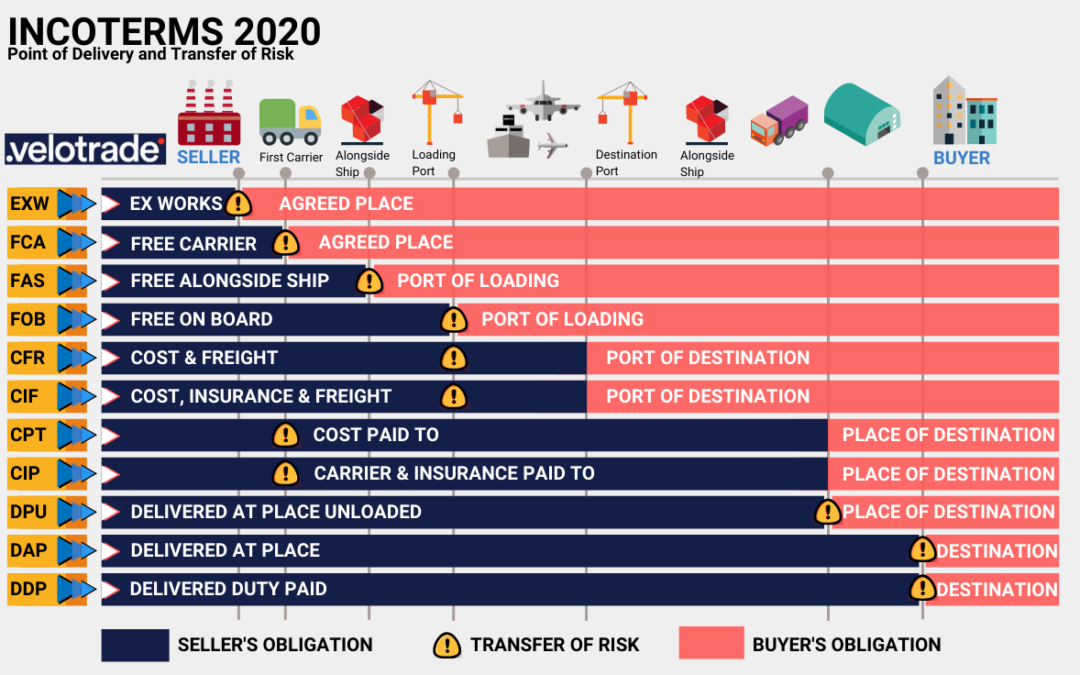

Incoterms 2020 consists of 11 terms which are grouped under four separate categories based on the first letter of each term:

– Departure (E) e.g. EXW (Ex Works)

– Main Carriage Unpaid (F) e.g. FOB (Free on Board)

– Main Carriage Paid (C) e.g. CIP (Carriage and Insurance Paid To)

– Arrival (D) e.g. DDP (Delivered Duty Paid)

Each group’s letter makes up the first letter of the Incoterm. For example, if your agreement with a buyer calls for the release of goods by the seller at the seller’s location, Ex Works (EXW) would be used because it confirms that the buyer takes over carriage and insurance responsibilities at the seller’s dock.

Alternatively, if the seller were to deliver goods to the buyers dock, including all carriage, insurance and duties paid, a term from the Arrival group such as DDP (Delivered Duty Paid) would be appropriate. DDP represents the most obligations for the seller, whereas EXW represents the least.

Catch the detailed list of Incoterms 2020 on the Velotrade Incoterms guide.

Costs Involved When Selecting Incoterms

Changing the Incoterm of an international trade contract should not be taken lightly and need to be the subject of detailed discussion between the buyer, shipper and financial intermediaries.

There are many implications for shipment arrangements, customs clearance, import and export tax liability, local transportation and insurance of goods, as well as – inevitably – for product pricing.

When taking responsibility for shipping, it is necessary to ensure that all documents are in order to meet customs clearance requirements, including:

- Shippers export declaration

- Certificate of Origin

- Bill of lading or airway bill

- Purchase order

- Invoice

- Packing list

- Manifests (including details of the cargo, the shipper, consignee, weight, measurement and packing list)

- Export and import licences (if required)

- Any other specific documentation as specified by the buyer, financial institution, L/C terms or as per importing country regulations

The arrangement of physical inspection of goods is also necessary to complete this process.

In addition to document preparation and submission, payment of relevant taxes is essential, including customs tariffs, VAT (where applicable), with Tax free zones also taken into account.

Shipping duties also require co-ordination of physical transportation, both locally – taking delivery of cargo from the factory and from customs after clearance along with documents – as well as international cargo shipment.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Incoterms are vital to supply chain finance. Discover supply chain finance benefits to realise its importance for your business.

How Incoterms Affect Trade Finance Opportunities

Familiarity with Incoterms often means that buyers and sellers take the easy option by following standard industry practice or simply sticking with the terms used in a previous sales agreement with the same customer.

In fact, there are some good reasons why SME manufacturers should carefully consider their choice of Incoterms for upcoming contracts. One of the key benefits to selecting specific Incoterms is the opportunity to obtain more favourable trade finance.

Learn the advantages of trade finance for both SMEs and corporates in strengthening their cash flow cycle.

Financing invoices is an increasingly popular form of trade finance – a tradeable asset with a tangible value. Manufacturers obtain working capital to cover the production and shipping cost of goods that the customer will pay some 30-90 days later.

However, an invoice can only be financed after the point at which transfer of risk for the goods takes place between the seller and the buyer. So if a seller wants to maximise the length of funding, it is important to select Incoterms that bring forward the transfer of ownership to the buyer as early as possible.

For example, this might mean considering FCA (Free Carrier) or FOB (Free On Board) rather than DPU (Delivered At Place Unloaded), DAP (Delivered At Place) or DDP (Delivered Duty Paid).

This chart provides an insight into changes made to the point of delivery and transfer of risk in Incoterms 2020.

A Final Word on Incoterms

It is important to reiterate that successful completion of a trade order is not dependent solely on the choice of the most appropriate Incoterms – it also depends on a carefully drafted contract that satisfies the buyer and seller equally. Nevertheless, with information provided by a partner such as Velotrade, a seller can arrange more favourable terms for its international orders under Incoterms 2020 and open the door to more effective trade finance.

Customised

Diverse

Global

Velotrade's dynamic Supply Chain Finance solution fulfills corporate's large trade volumes financing imports and exports from multiple suppliers.